Overview

This article identifies nine essential features that are crucial for the successful development of fintech mobile applications. Among these features are secure user authentication, real-time transaction processing, and robust customer support. Each of these elements plays a pivotal role, enhancing user experience and security while ensuring compliance with regulatory standards. This, in turn, fosters customer trust and satisfaction in a rapidly evolving financial technology landscape. By prioritizing these features, developers can create applications that not only meet user expectations but also establish a strong reputation in the market.

Introduction

The rapid evolution of the fintech sector underscores a critical demand for mobile applications that not only comply with regulatory standards but also significantly enhance user engagement and satisfaction. With financial technology projected to exceed $1 trillion by 2032, it is imperative for organizations to grasp the key features that drive successful fintech app development to remain competitive.

How can developers guarantee that their applications not only adhere to regulations but also deliver a seamless, user-friendly experience that encourages customer loyalty? This article delves into nine essential features that can elevate fintech mobile app development into a formidable asset for both businesses and users alike.

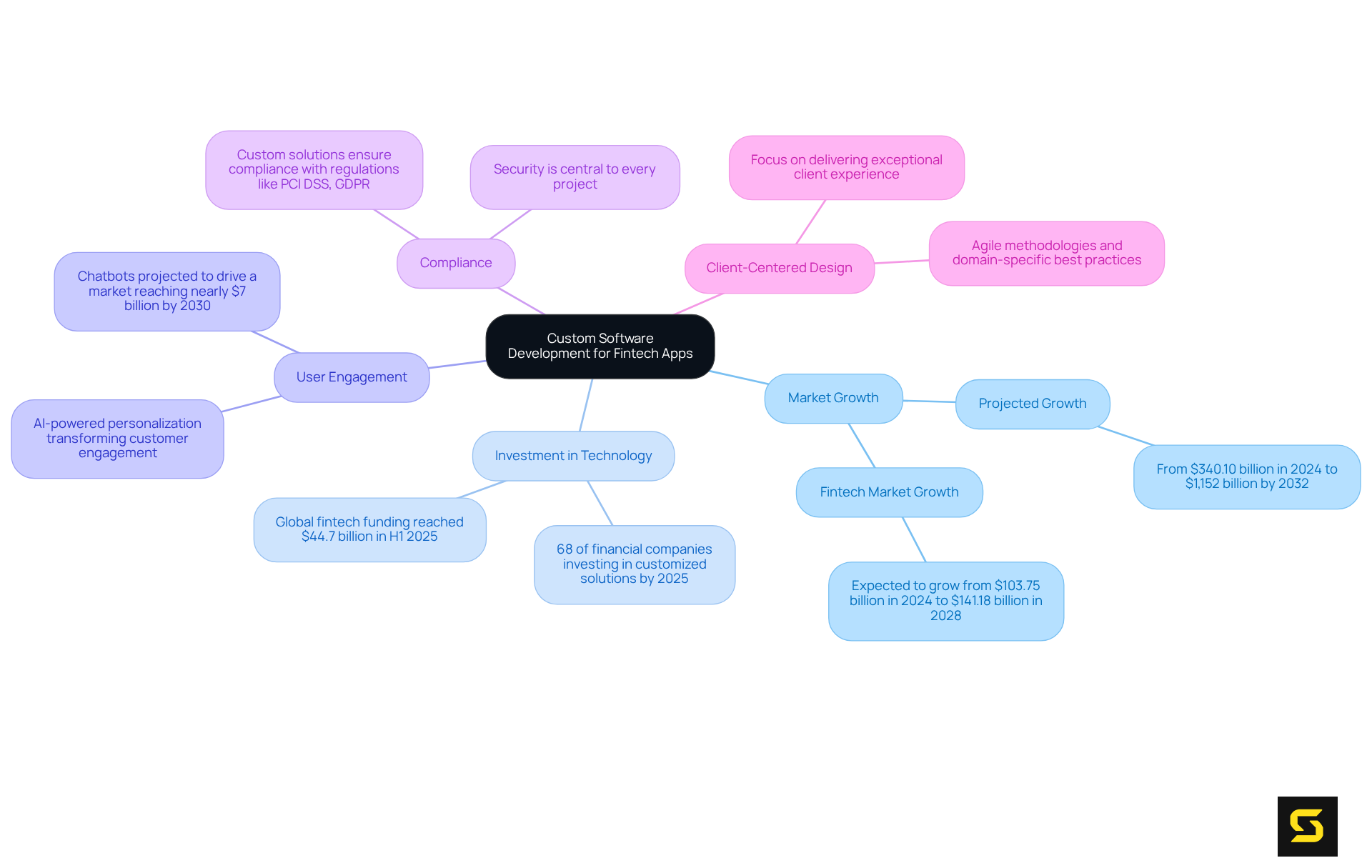

SDA: Custom Software Development for Fintech Apps

SDA stands at the forefront of fintech mobile app development, with custom software specifically designed for financial technology applications, leveraging cutting-edge technologies and user-centric design principles. This approach seamlessly integrates strategic planning with innovative solutions, guaranteeing that fintech mobile app development not only complies with regulatory standards but also significantly enhances user engagement and satisfaction.

With the financial technology sector projected to grow from $340.10 billion in 2024 to $1,152 billion by 2032, the demand for fintech mobile app development solutions is more critical than ever. In fact, by 2025, 68% of financial companies are expected to invest in customized technology solutions to bolster compliance, security, and operational efficiency.

By addressing the unique challenges faced by the financial technology sector, SDA positions itself as a reliable partner for organizations aiming to excel in fintech mobile app development and technological innovation within finance. Proven case studies illustrate how custom software can optimize operations and deliver real-time visibility, ultimately fostering improved outcomes for businesses.

With a commitment to client-centered design, SDA ensures that each application not only meets functional requirements but also delivers an exceptional client experience, laying the groundwork for sustained growth and a competitive advantage in the evolving financial technology landscape.

Secure User Authentication: Protecting Financial Data

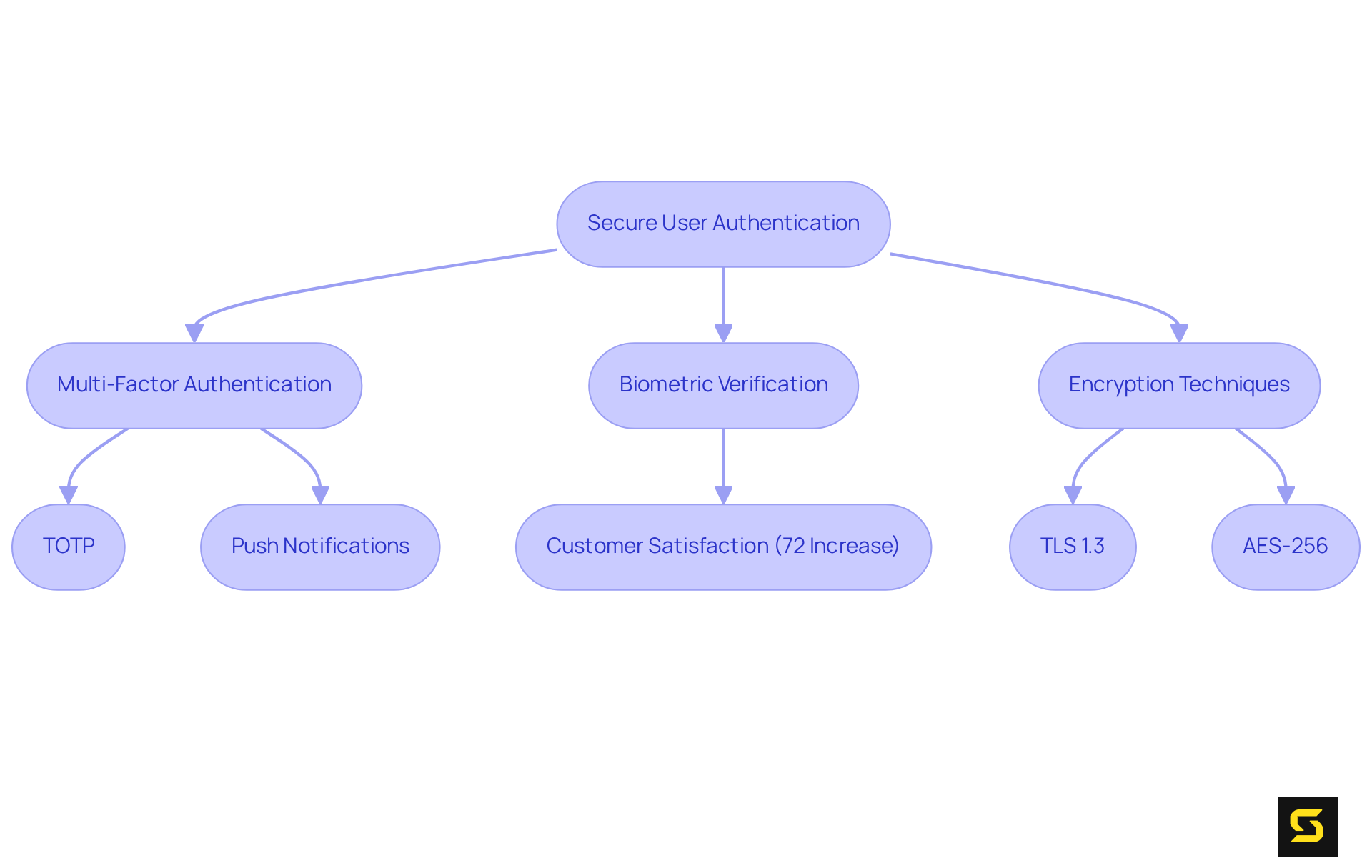

In fintech mobile app development, secure account authentication is not just important; it is essential. Implementing multi-factor authentication (MFA) and biometric verification methods significantly enhances safety, protecting individual information and fostering trust—critical elements for user retention. Notably, biometric verification can lead to a remarkable 72% increase in customer satisfaction, as individuals highly value the convenience and security it offers.

By employing advanced encryption techniques, such as TLS 1.3 for data in transit and AES-256 for stored data, alongside secure API integrations, fintech applications can effectively safeguard credentials and financial transactions from unauthorized access.

Best practices for MFA include:

- Utilizing time-based one-time passwords (TOTP)

- Push notifications

These practices not only bolster security but also streamline the user experience. Practical examples, such as UnionDigital Bank's collaboration with iProov to enhance its authentication strategy, demonstrate how integrating biometric solutions can substantially mitigate fraud risks and elevate client confidence.

As the financial technology landscape evolves, prioritizing robust authentication techniques in fintech mobile app development will be paramount for maintaining trust among users and ensuring compliance with regulatory standards.

Real-Time Transaction Processing: Enhancing User Experience

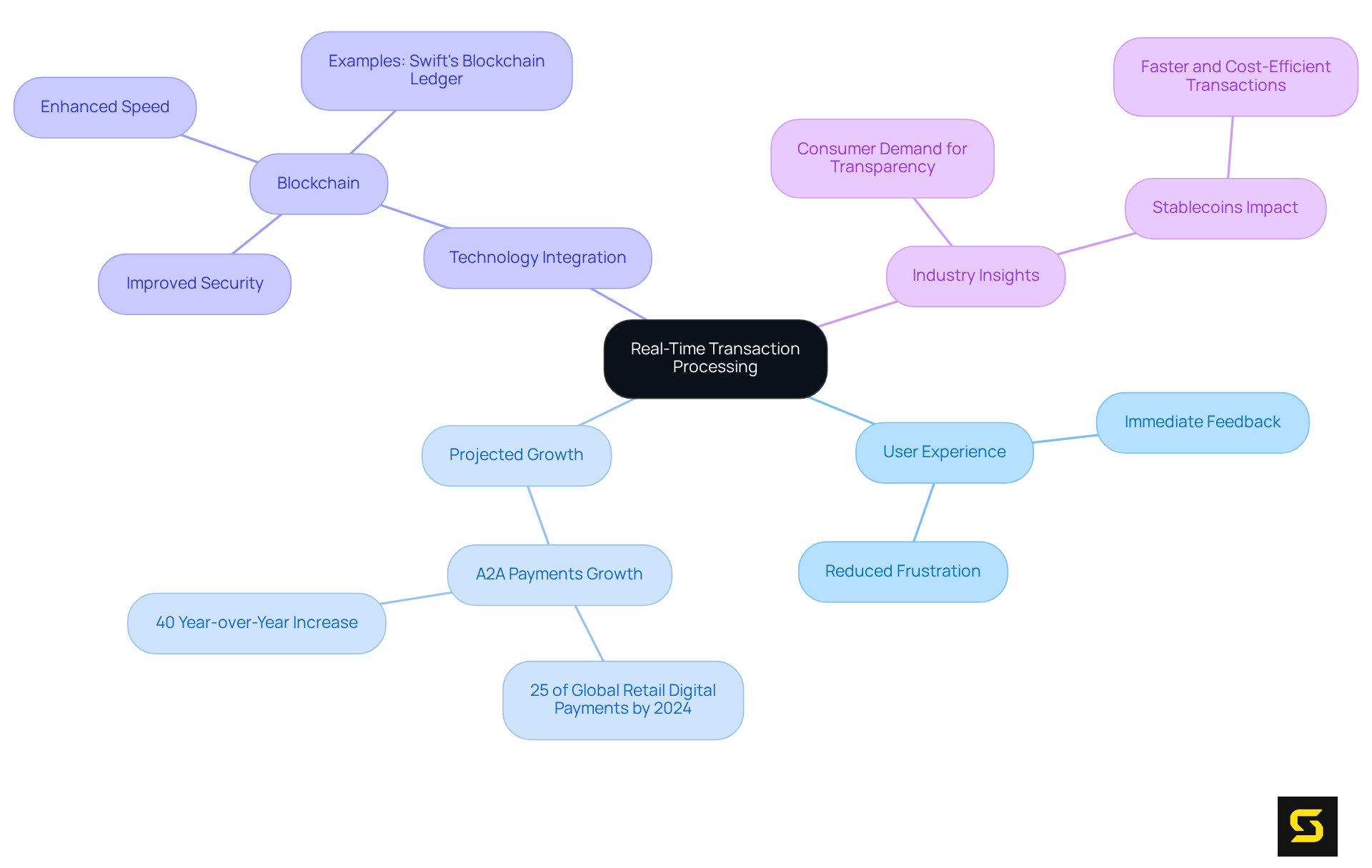

Real-time transaction processing stands as a cornerstone for financial technology solutions, enabling individuals to execute transactions instantly and without delays. This capability not only significantly enhances user experience by offering immediate feedback but also alleviates the frustrations typically linked with traditional banking methods.

For example, real-time account-to-account (A2A) payments are projected to account for approximately a quarter of global retail digital payments by 2024, reflecting a remarkable 40% year-over-year increase. By integrating advanced technologies such as blockchain, fintech solutions can further streamline transactions, thereby enhancing both speed and security.

The anticipated adoption of blockchain technology within financial sectors is set to revolutionize transaction speeds, with firms like Swift developing blockchain ledgers to facilitate immediate cross-border payments. This integration not only boosts operational efficiency but also fosters greater customer satisfaction and loyalty, as consumers increasingly demand quicker and more transparent payment solutions.

As Jesse Hemson-Struthers, CEO of BVNK, aptly states, 'Stablecoins are redefining how money moves across the world—faster, more cost-efficient, and with fewer barriers.' These advancements underscore the vital role of real-time processing and blockchain technology in shaping the future of financial technology solutions.

Payment Gateway Integration: Streamlining Transactions

Incorporating a payment gateway is crucial for financial technology applications, as it empowers individuals to conduct secure transactions with ease. Selecting the appropriate payment gateway can significantly streamline the transaction process, lower fees, and enhance the overall customer experience. Key considerations for financial technology applications include:

- Transaction speed

- Robust security features

- Compatibility with a variety of payment methods

By leveraging APIs from leading payment processors, developers can craft a transaction experience that not only meets but exceeds expectations. For example, providers such as Stax and Square deliver competitive transaction fees alongside user-friendly interfaces, making them exemplary choices for fintech applications. Additionally, the ability to manage transactions in multiple currencies further broadens global reach, catering to a diverse clientele.

As the demand for integrated payment solutions escalates, prioritizing transaction speed and security is essential, with industry experts highlighting that even minor enhancements in these areas can yield significant revenue gains for businesses. Ultimately, effective payment gateway integration is a cornerstone of successful fintech app development, driving customer satisfaction and operational efficiency.

Personalized Financial Insights: Empowering Users

Customized financial insights empower individuals by delivering tailored suggestions based on their spending patterns and financial objectives. Fintech mobile app development utilizes data analytics and machine learning algorithms to scrutinize individual behavior, providing insights that enhance engagement and foster a sense of ownership over financial decisions.

As Prasoon Verma asserts, "Big data is revolutionizing the FinTech industry, reshaping how companies operate, serve customers, and manage risks." By offering practical guidance and timely notifications, these applications enable individuals to manage their finances more effectively, leading to improved financial literacy and overall satisfaction.

Furthermore, real-time transaction monitoring, powered by machine learning algorithms, can identify unusual activities, bolstering security and trust for users. As the financial technology landscape evolves, fintech mobile app development that incorporates advanced analytics becomes crucial for creating hyper-personalized experiences that resonate with individuals, ultimately cultivating loyalty and retention.

For financial technology product owners, adopting data analytics strategies such as predictive modeling can significantly elevate engagement and satisfaction in the context of fintech mobile app development.

Robust Customer Support: Enhancing User Satisfaction

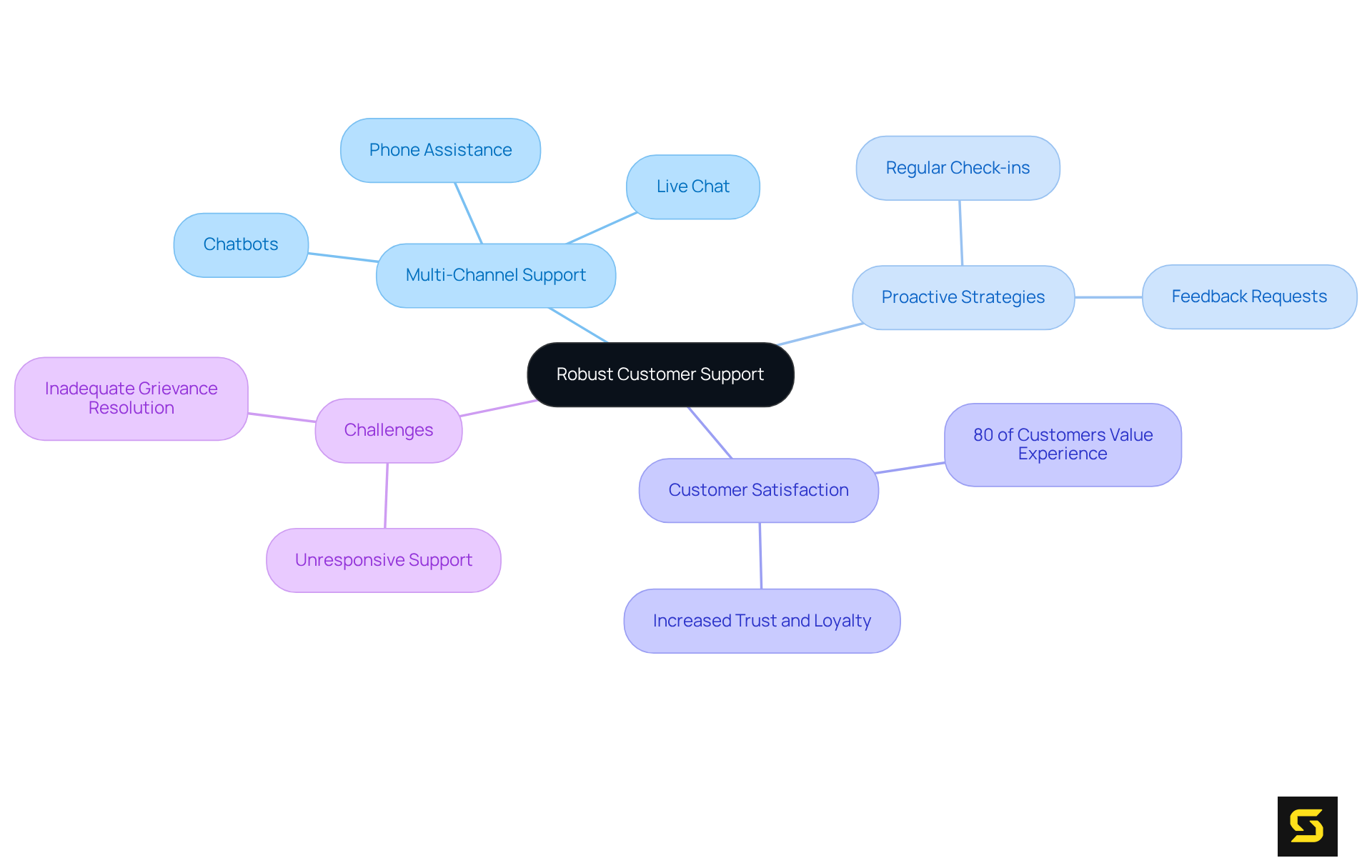

Strong customer support is paramount for financial technology applications, as clients often require assistance with complex financial transactions. Implementing multi-channel support options—such as chatbots, live chat, and phone assistance—can significantly elevate customer satisfaction. By delivering timely and effective responses to inquiries, fintech companies can foster trust and loyalty. For instance, Chime has successfully reduced inbound support volume by over 20% through proactive communication strategies, including real-time alerts and data analytics, thereby demonstrating the power of anticipating client needs. Furthermore, Monzo's 'chat-first' support system, which employs intelligent routing and automation, has enhanced customer response times by more than 60%, illustrating the advantages of personalized and immediate assistance.

Proactive customer support, encompassing regular check-ins and feedback requests, is instrumental in identifying areas for improvement and cultivating a positive client experience. With customer expectations on the rise, the necessity of maintaining a consistent tone of voice and support policies across all channels is critical. Notably, 80% of customers value experience as highly as the product itself, underscoring the importance of this consistency in customer service. Businesses that prioritize multi-channel assistance not only enhance client satisfaction but also position themselves as leaders in fintech mobile app development within the competitive financial technology sector, ultimately nurturing customer loyalty and retention. Nevertheless, challenges such as unresponsive support and inadequate grievance resolution persist as significant issues that financial technology firms must address to improve the overall user experience.

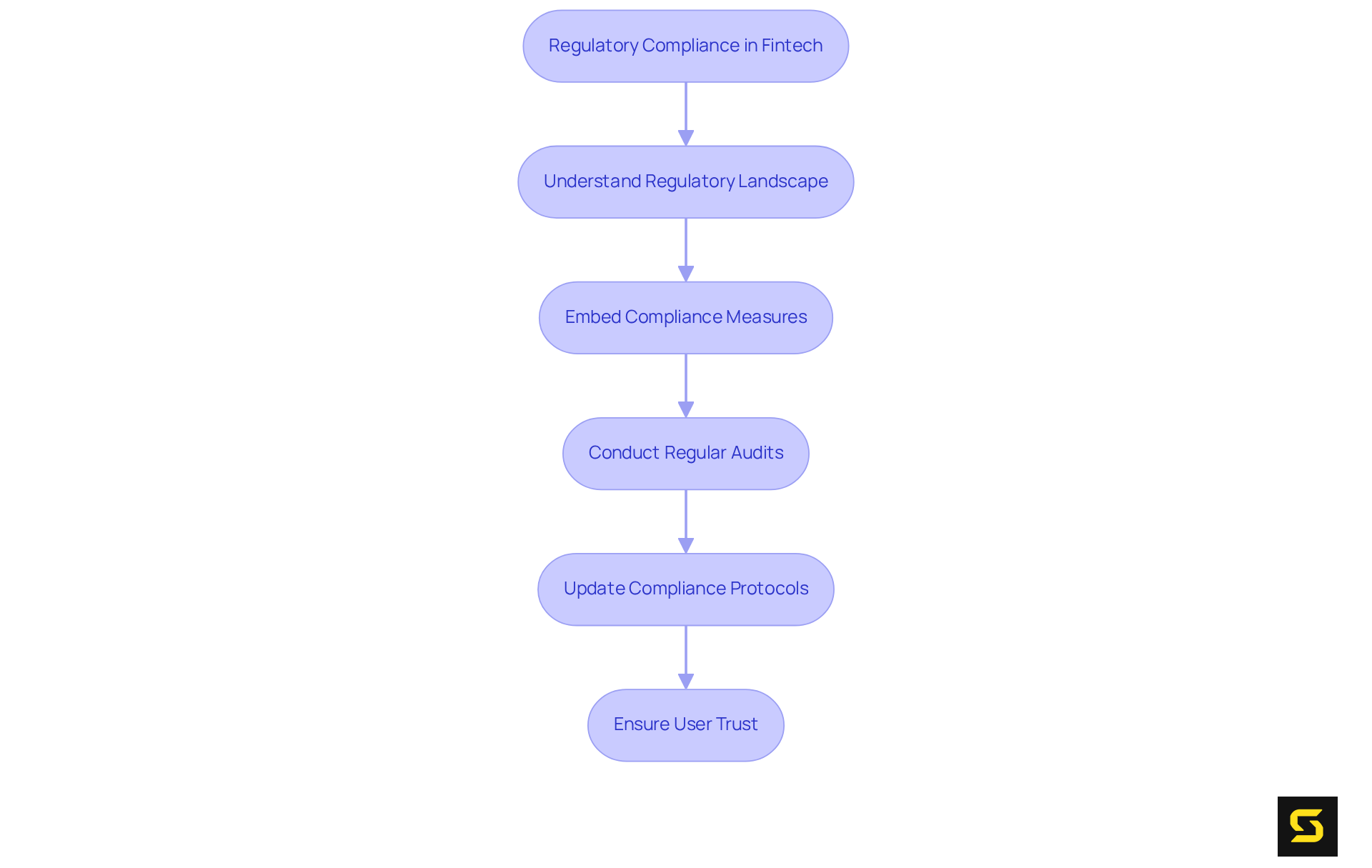

Regulatory Compliance: Ensuring Legal Operations

Regulatory compliance is a cornerstone for the success of fintech mobile app development. Companies operating in this sector navigate a complex regulatory landscape that encompasses stringent data protection laws, anti-money laundering (AML) requirements, and Know Your Customer (KYC) protocols.

By embedding compliance measures throughout the fintech mobile app development lifecycle, fintech firms can effectively mitigate risks and avert substantial penalties. Regular audits and timely updates to compliance protocols are essential for adapting to evolving regulations and preserving trust among stakeholders.

Legal specialists emphasize that a proactive compliance strategy not only safeguards against regulatory violations but also enhances the overall user experience, fostering a secure and trustworthy platform for financial transactions.

As the financial technology sector continues to advance, staying ahead of regulatory changes will be vital for sustained growth and innovation.

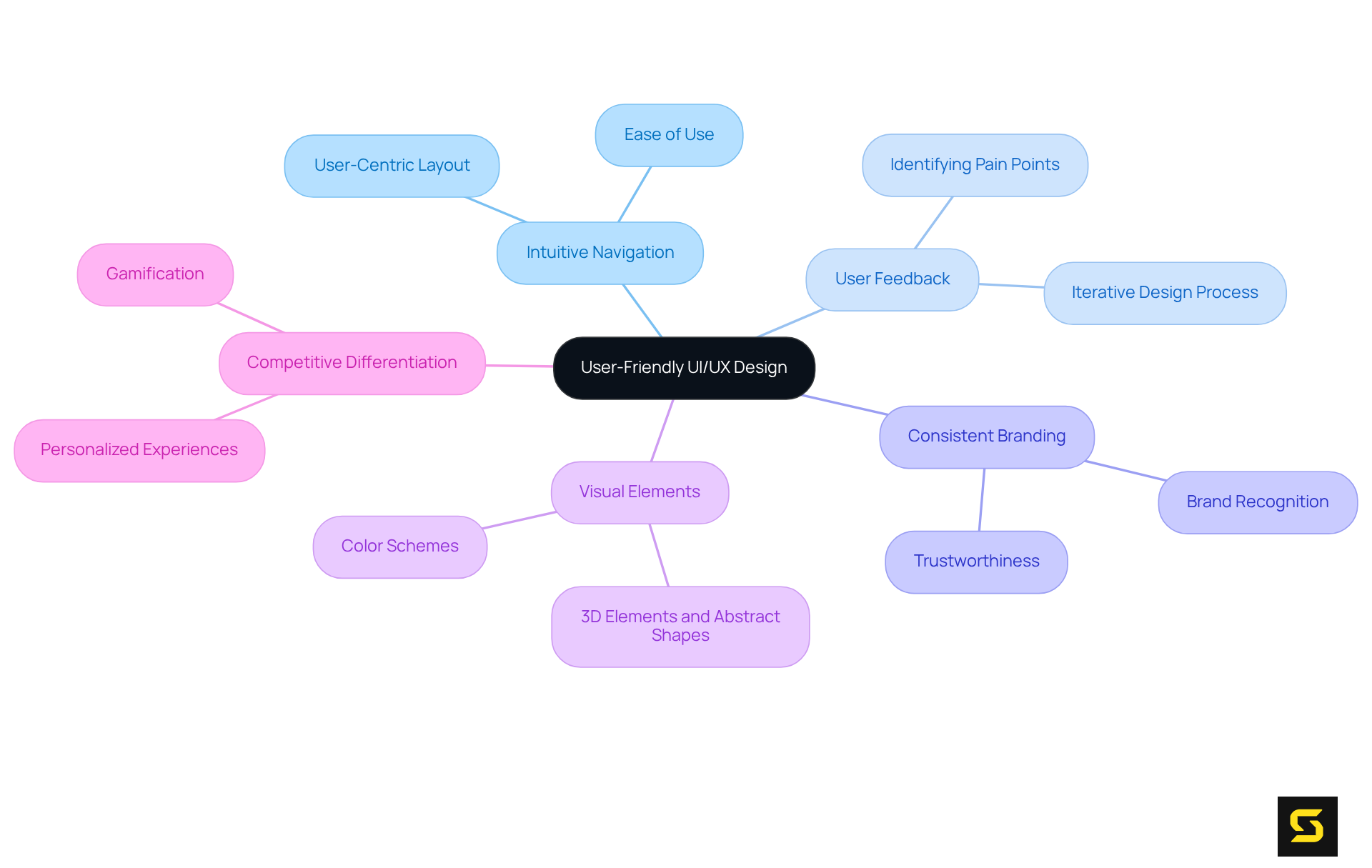

User-Friendly UI/UX Design: Attracting and Retaining Users

Intuitive UI/UX design is paramount for fintech applications, significantly influencing user engagement and retention. A meticulously crafted interface must be intuitive, allowing users to navigate the app with ease. By incorporating user feedback throughout the design process, firms can identify pain points and elevate usability. Moreover, the use of consistent branding and visual elements not only enhances the user experience but also cultivates a sense of trustworthiness in the application. Prioritizing user-centric design in fintech mobile app development enables financial technology firms to differentiate themselves in an increasingly competitive market, driving them towards success.

Data Security Measures: Protecting Against Cyber Threats

In the realm of fintech mobile app development, data protection is not merely important; it is imperative due to the sensitive nature of financial information handled by these systems. Strong encryption protocols are essential, serving as a barrier against unauthorized access and cyber threats. Additionally, secure coding practices must be prioritized to eliminate vulnerabilities that could be exploited by malicious actors. Regular assessments are critical for identifying and mitigating potential risks, ensuring that applications remain resilient against ever-evolving threats.

Education is a cornerstone of enhanced safety; individuals must be equipped to recognize phishing attempts and understand the importance of robust, unique passwords. Furthermore, conducting simulated social engineering tests can significantly elevate individual awareness and preparedness against cyber threats. By fostering a culture of vigilance regarding safety, fintech firms can substantially reduce the likelihood of successful attacks.

The impact of these protective measures extends beyond mere compliance with regulatory standards; they are vital for building trust among consumers. With cybercrime damage projected to reach $10.5 trillion annually by 2025, and the average cost of a single data breach for finance firms now at $6.08 million, the stakes are extraordinarily high. Successful examples, such as the implementation of advanced protective measures in platforms like Bajaj Finserv—featuring multi-factor authentication and secure APIs—demonstrate how prioritizing cybersecurity in fintech mobile app development can facilitate safe transactions and enhance user confidence.

In this context, experts emphasize that integrating protection at every stage of fintech mobile app development is crucial. As one cybersecurity expert asserted, "Creating a secure solution that fully protects financial technology data security requires embedding security throughout the software development lifecycle." This comprehensive approach not only safeguards sensitive information but also positions financial technology firms as trustworthy partners within the financial ecosystem.

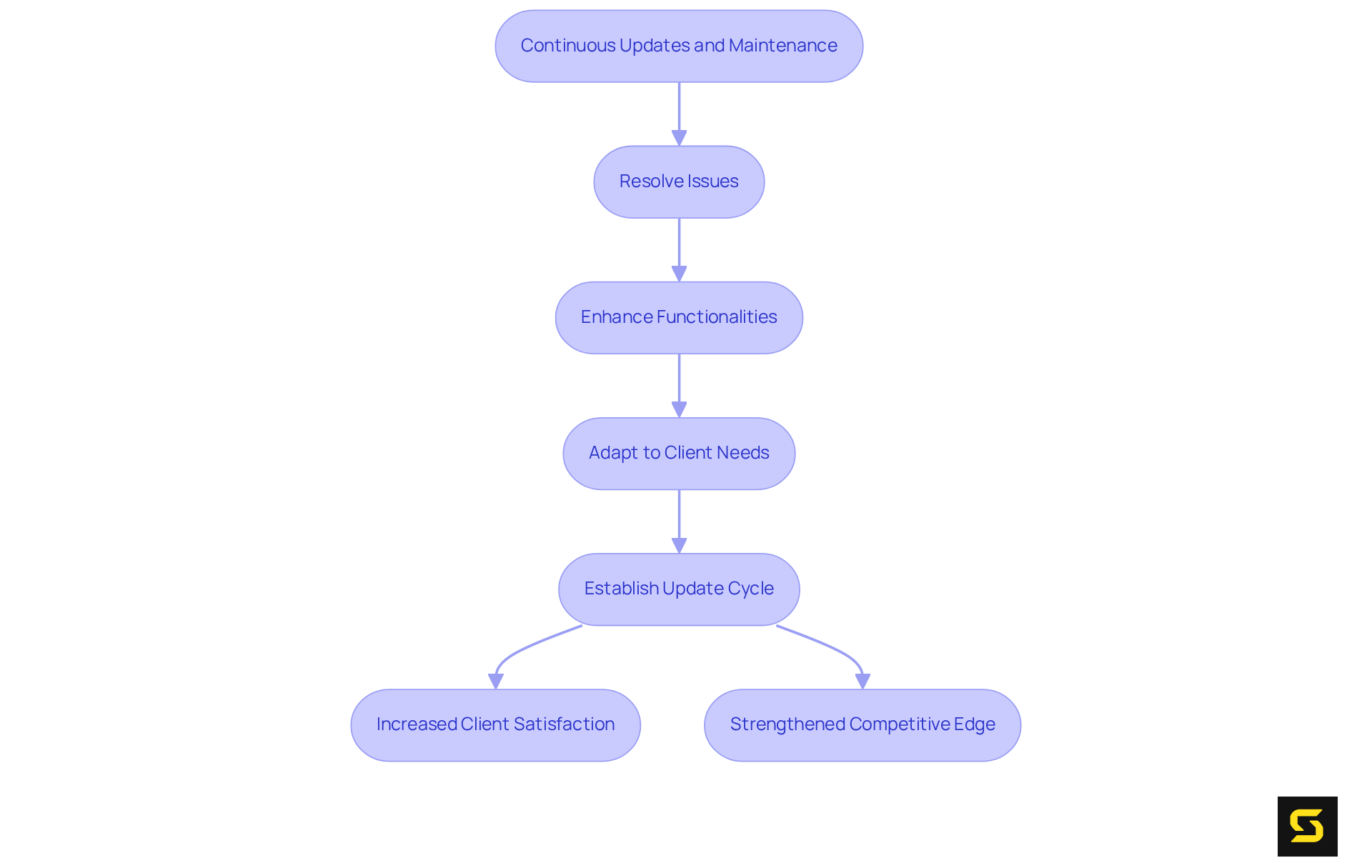

Continuous Updates and Maintenance: Ensuring App Relevance

Ongoing updates and maintenance are paramount for the sustained success of fintech mobile app development solutions. By consistently resolving issues, enhancing functionalities, and adapting to evolving client needs, businesses not only maintain the application's relevance but also strengthen their competitive edge. A meticulously organized maintenance plan, incorporating feedback loops from users and performance monitoring, is essential for identifying areas ripe for improvement. Companies prioritizing continuous support often witness increased client satisfaction and loyalty. For instance, the anticipated growth in digital wallet adoption—projected to account for 79% of e-commerce value by 2030—highlights the critical need for efficient app maintenance to sustain user engagement.

Moreover, establishing a disciplined update cycle—ideally every 12 to 18 months—ensures that applications remain contemporary and visually appealing, in line with design trends and compliance standards. Regular UI updates are vital for maintaining both attractiveness and functionality. By positioning maintenance as a core growth driver, fintech mobile app development firms can adeptly navigate the complexities of the regulatory landscape while enhancing user experiences and fostering long-term engagement. Notably, companies that adopt this maintenance-centric approach are expected to distinguish themselves by 2025.

Additionally, leveraging tools such as Bugsee or Instabug facilitates the capture of real-time errors, ensuring that maintenance efforts are proactive rather than reactive. Clearly defining roles and responsibilities for maintenance is crucial, ensuring it is regarded as a dedicated task rather than an ancillary project. In conclusion, prioritizing ongoing updates and maintenance is not merely beneficial; it is essential for achieving lasting success in fintech mobile app development.

Conclusion

The successful development of fintech mobile applications is fundamentally anchored in a multitude of key features that collectively enhance user experience, security, and operational efficiency. By prioritizing these essential elements—secure user authentication, real-time transaction processing, robust customer support, and regulatory compliance—fintech companies can craft applications that not only satisfy the demands of today's users but also strategically position themselves for future growth in a rapidly evolving market.

This article underscores the significance of integrating advanced technologies, such as machine learning for personalized financial insights and blockchain for transaction processing. Furthermore, maintaining a user-friendly interface and implementing comprehensive data security measures are critical for fostering trust and satisfaction among users. Continuous updates and maintenance are essential to ensure that applications remain relevant and competitive, adapting to the evolving needs and expectations of consumers.

As the financial technology landscape continues to expand, embracing these key features is not merely an option but a necessity for success. Companies that prioritize user-centric design, compliance with regulatory standards, and proactive customer support will not only elevate their reputation but also cultivate long-term loyalty among users. The future of fintech app development resides in the ability to innovate while consistently delivering exceptional experiences, thereby establishing a standard that others in the industry will aspire to meet.

Frequently Asked Questions

What is SDA's role in fintech mobile app development?

SDA specializes in custom software development for fintech applications, focusing on integrating strategic planning with innovative solutions that enhance user engagement and comply with regulatory standards.

What is the projected growth of the financial technology sector?

The financial technology sector is projected to grow from $340.10 billion in 2024 to $1,152 billion by 2032.

Why is secure user authentication important in fintech apps?

Secure user authentication is essential in fintech apps to protect sensitive financial data, foster trust, and enhance user retention.

What methods enhance account security in fintech applications?

Multi-factor authentication (MFA) and biometric verification methods significantly enhance account security.

How can biometric verification impact customer satisfaction?

Biometric verification can lead to a 72% increase in customer satisfaction due to its convenience and security features.

What encryption techniques are recommended for fintech applications?

Recommended encryption techniques include TLS 1.3 for data in transit and AES-256 for stored data, along with secure API integrations.

What are some best practices for implementing multi-factor authentication?

Best practices for MFA include utilizing time-based one-time passwords (TOTP) and push notifications.

What is the significance of real-time transaction processing in fintech?

Real-time transaction processing allows for instant transactions and immediate feedback, significantly enhancing user experience and reducing frustrations associated with traditional banking.

What is the expected growth of account-to-account payments by 2024?

Account-to-account (A2A) payments are projected to account for approximately a quarter of global retail digital payments by 2024, reflecting a 40% year-over-year increase.

How does blockchain technology influence transaction processing in finance?

Blockchain technology facilitates faster and more secure transactions, revolutionizing transaction speeds and enhancing operational efficiency in the financial sector.