Overview

Choosing the right finance software development company is critical for business success. Companies must prioritize several key criteria:

- Experience in the financial sector

- Technical skills in relevant technologies

- A well-defined development methodology

Understanding these factors is essential. Moreover, evaluating support services and cost structures is crucial for establishing a successful partnership that not only meets specific project needs but also complies with industry regulations. By focusing on these elements, businesses can ensure they select a partner capable of delivering exceptional results.

Introduction

Selecting the right finance software development company is a critical endeavor, particularly in an industry where precision, compliance, and security are non-negotiable. As the financial technology landscape undergoes rapid transformation, businesses face the challenge of navigating a complex array of criteria to ensure they partner with a firm that not only fulfills their technical requirements but also aligns with their strategic objectives.

How can organizations effectively evaluate potential vendors and make informed decisions that lead to successful software solutions? This guide explores the essential factors to consider when choosing a finance software development partner, offering insights designed to streamline the decision-making process and enhance project outcomes.

Understand Financial Software Development

Financial application development involves the creation of tools designed to manage financial transactions, reporting, and analytics. Understanding the unique requirements of this sector is crucial, particularly in the following areas:

-

Regulatory Compliance: Financial software must comply with stringent regulations such as GDPR, PCI DSS, and others, varying by region and type of financial service. The RegTech market is projected to expand to $22.3 billion by 2027, highlighting the increasing importance of compliance in financial technology.

-

Security Features: Given the sensitive nature of financial data, robust security measures—such as encryption and secure access protocols—are essential. The rise of cyber threats in the fintech sector underscores the need for advanced security frameworks that can adapt to emerging risks.

-

User Experience (UX): A user-friendly interface is vital to ensure users can navigate the application effectively, which is particularly important in finance where users may lack technical expertise. As competition intensifies, prioritizing UX will become a key differentiator for financial service providers.

-

Integration Capabilities: Financial applications often require connectivity with other systems, such as banking APIs, accounting programs, and CRM systems, to deliver a seamless experience. This interoperability is essential for creating a cohesive user experience and optimizing operational efficiency.

By thoroughly understanding these aspects, businesses can more accurately define their scope and expectations when collaborating with software firms.

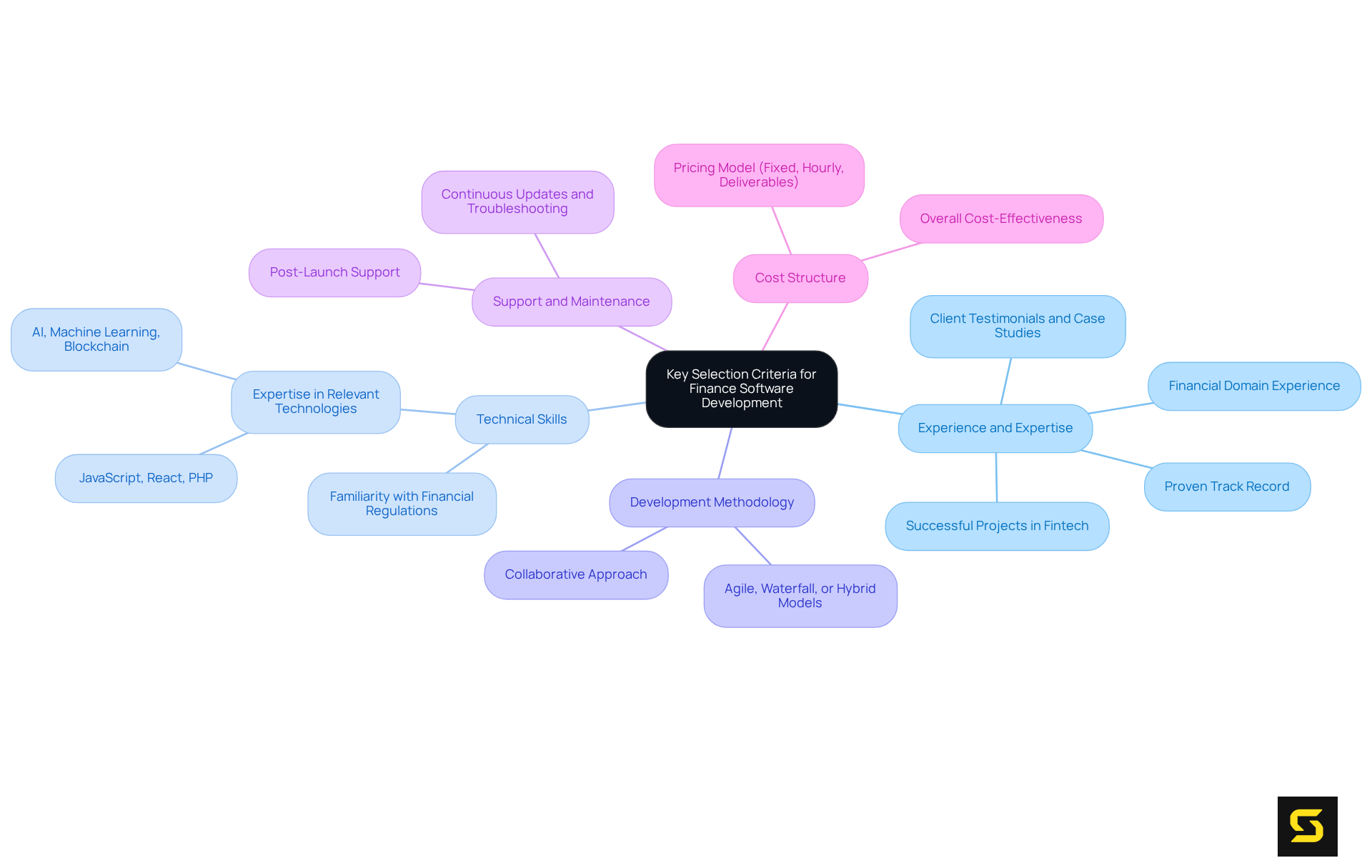

Identify Key Selection Criteria

When selecting a finance software development company, it is imperative to consider the following key criteria:

-

Experience and Expertise: Prioritize companies with a robust track record in financial software development. A proven history of successful projects in the finance software development company sector, particularly in fintech, is essential. Look for client testimonials and case studies that demonstrate their ability to navigate complex financial regulations and deliver effective solutions. Proven financial domain experience is crucial for a finance software development company, as it equips their development teams with insights into industry-specific regulations and best practices, enabling them to anticipate challenges related to transaction scalability and compliance-driven design.

-

Technical Skills: Ensure the company possesses expertise in relevant technologies such as JavaScript, React, and PHP. Familiarity with financial regulations and compliance standards is crucial, as it directly impacts the quality and security of the software developed. Companies that are finance software development companies with a strong focus on advanced technology competencies, including AI, Machine Learning, and Blockchain, are particularly valuable, as these skills enhance data processing and risk management capabilities.

-

Development Methodology: Inquire about their development approach, whether Agile, Waterfall, or a hybrid model. Understanding how their methodology aligns with your project timeline and flexibility needs can significantly influence the project's success. Companies that emphasize a collaborative approach, allowing for iterative changes based on user feedback, tend to deliver more tailored solutions.

-

Support and Maintenance: Assess the level of post-launch support and maintenance offered. Continuous updates and troubleshooting are critical in the financial sector, where compliance and security are paramount. A dedicated support team can ensure that the system remains operational and secure over time, integrating compliance and security measures into ongoing maintenance.

-

Cost Structure: Understand their pricing model, whether fixed, hourly, or based on deliverables. Ensure that it aligns with your budget while providing a clear value proposition. Evaluating the overall cost-effectiveness of their services, including potential ROI and the overall value proposition, is essential for long-term success.

By establishing these standards, you can streamline your search and focus on a finance software development company that meets your specific requirements, ultimately leading to a successful collaboration in developing robust financial applications.

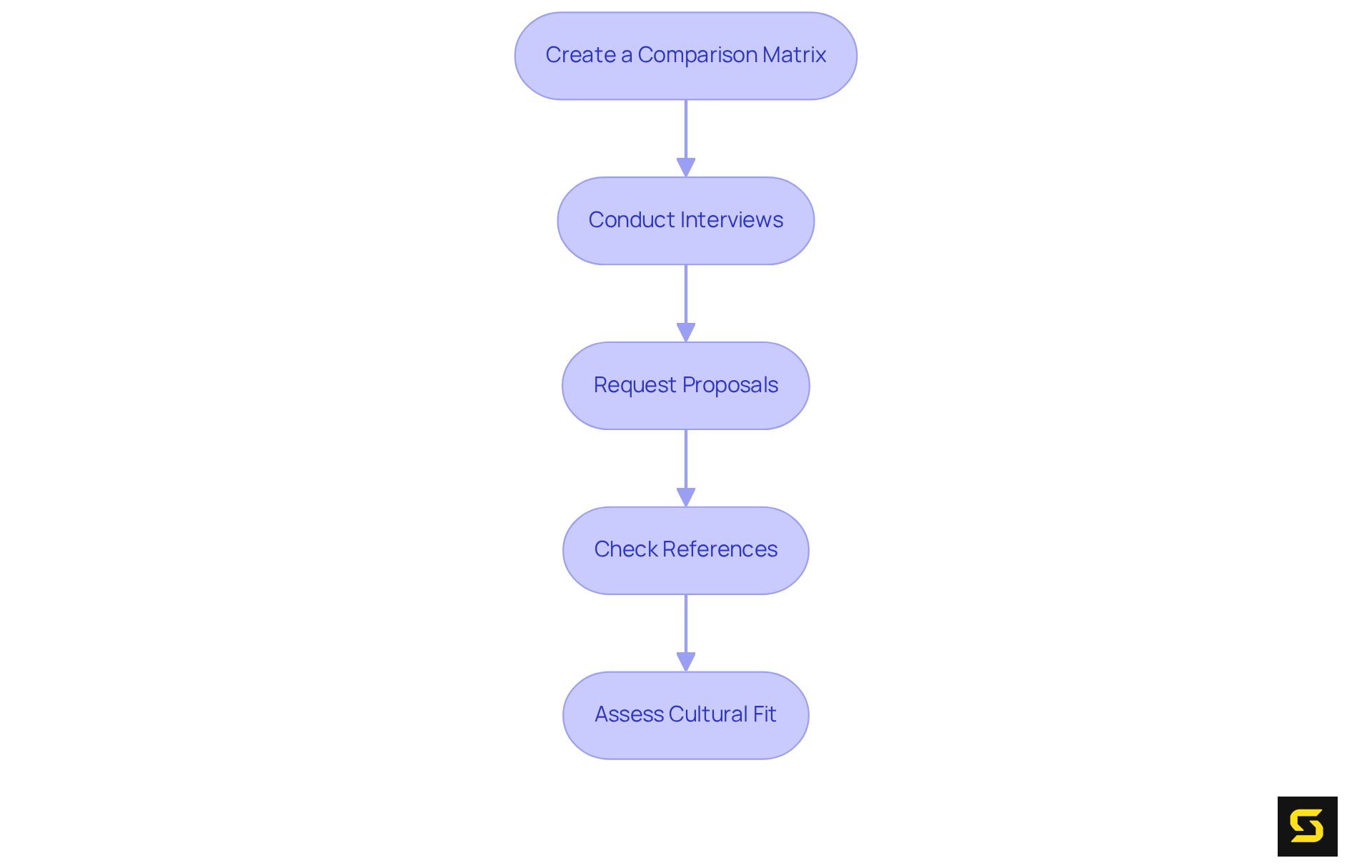

Evaluate and Compare Development Companies

To effectively evaluate and compare finance software development companies, follow these essential steps:

-

Create a Comparison Matrix: Develop a matrix that lists potential firms alongside key selection criteria such as technical expertise, project methodology, and client satisfaction. This visual tool enables a side-by-side comparison of each organization's strengths and weaknesses, facilitating a clearer decision-making process. As Matt Watson, CEO of Full Scale, emphasizes, "The value of RFP for software development is undeniable in today’s competitive environment."

-

Conduct Interviews: Arrange meetings with shortlisted companies to explore the details of the assignment. Focus on their communication style, responsiveness, and their capability to understand your requirements. This interaction can reveal much about their approach and compatibility with your needs. A strong cultural fit can enhance collaboration and lead to a more successful partnership.

-

Request Proposals: Solicit detailed proposals that outline their methodologies, timelines, and cost structures. This will provide insight into their understanding of your project and their capability to deliver on expectations. A well-articulated proposal demonstrates an organization's commitment to quality and alignment with your goals. Remember, transparent pricing and flexible contract terms are essential when selecting a software vendor.

-

Check References: Reach out to previous clients to gather feedback on their experiences. Inquire specifically about the organization's reliability, quality of work, and the effectiveness of their post-launch support. High client retention rates often indicate a vendor's ability to foster lasting relationships and deliver satisfactory results. As noted, "A high client retention rate suggests that a vendor builds lasting relationships with clients."

-

Assess Cultural Fit: Evaluate the organization's culture and values. A strong cultural alignment can enhance collaboration and lead to a more successful partnership. Consider how their operational style and values resonate with your organization’s mission and objectives.

By following these steps, you can make a well-informed choice that aligns with your objectives, ensuring a successful partnership with the finance software development company you select. Additionally, referencing case studies such as the "Vendor Selection Criteria Overview" can provide real-world context to the importance of clear vendor selection criteria.

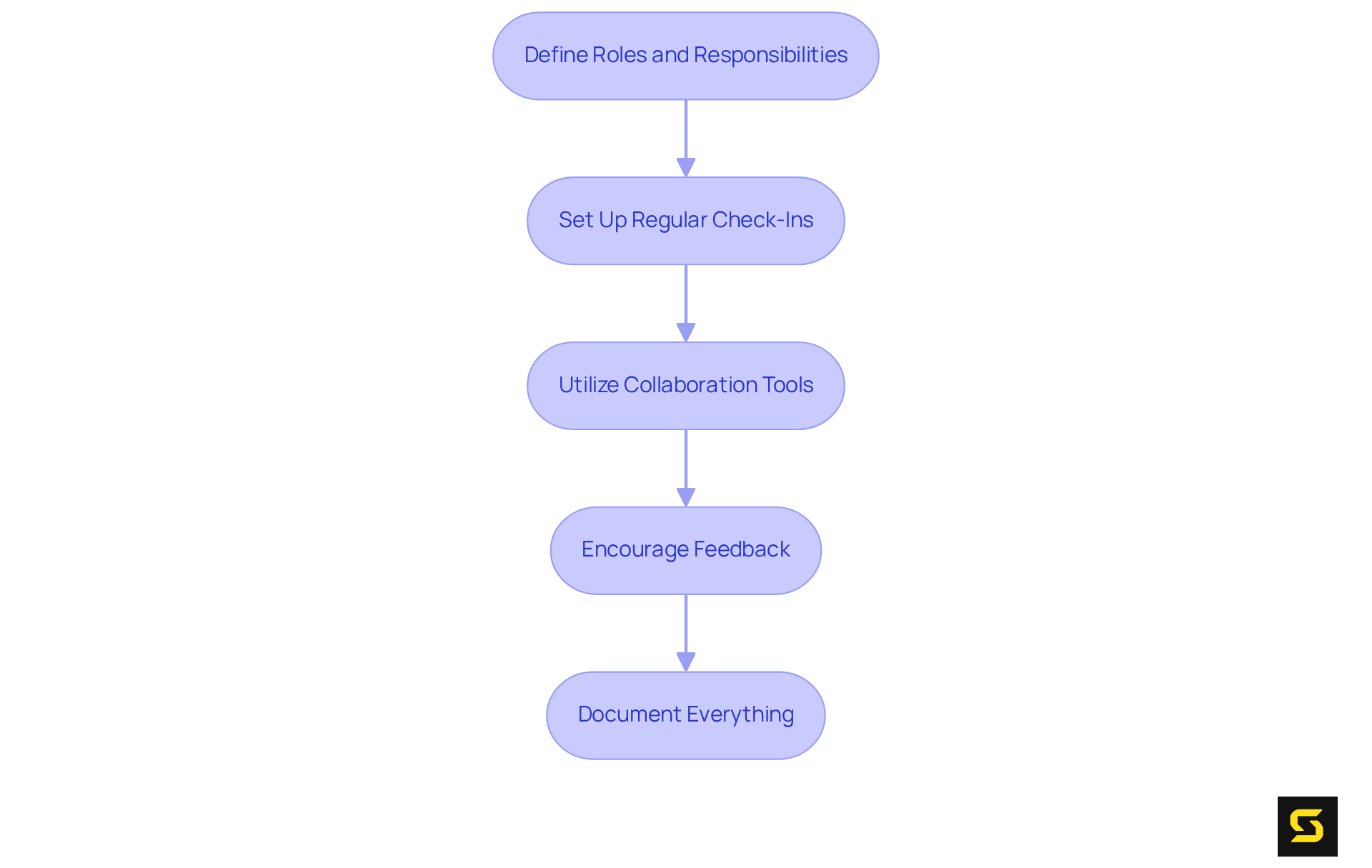

Establish Partnership and Communication Strategies

Once you have chosen a finance software development company, establishing robust partnership and communication strategies is essential for success.

-

Define Roles and Responsibilities: Clearly outline the roles of both your team and the development team. This clarity is essential; it aids in avoiding misunderstandings and guarantees accountability—critical elements in intricate endeavors, especially considering that 59% of IT initiatives utilize distributed teams.

-

Set Up Regular Check-Ins: Schedule regular meetings to discuss progress, address any issues, and adjust timelines as necessary. Frequent check-ins, such as weekly or bi-weekly meetings, keep everyone aligned and informed, fostering a culture of transparency and collaboration. Indeed, frequent progress reports can significantly improve team dynamics and results, as emphasized in several case studies.

-

Utilize Collaboration Tools: Implement management and communication tools like Slack, Trello, or Jira to facilitate real-time collaboration and updates. These platforms not only enhance visibility into timelines and task assignments but also streamline workflows, significantly boosting team productivity. As industry specialists indicate, effective utilization of these tools can lead to quicker software delivery and enhanced results.

-

Encourage Feedback: Foster an open environment where both teams can provide feedback on processes and deliverables. This practice promotes ongoing enhancement and creativity, aligning with agile methodologies that emphasize iterative progress and adaptability to change. As Mukesh Ram states, "Successful remote work demands effective communication, which is not so easy to maintain in this changing environment."

-

Document Everything: Maintain thorough documentation of requirements, changes, and decisions made throughout the development process. Well-documented initiatives are easier to comprehend and operate more smoothly, minimizing the risk of misunderstandings that can lead to expensive delays. Transparent documentation methods have been shown to improve overall communication and the success of initiatives.

By implementing these strategies, you can cultivate a productive partnership that significantly enhances the likelihood of project success.

Conclusion

Choosing the right finance software development company is not just a decision; it is a pivotal factor that can shape the success of your financial applications. Understanding the unique requirements of financial software development—such as regulatory compliance, security features, user experience, and integration capabilities—establishes a solid foundation for your projects. This foundational knowledge empowers organizations to articulate their needs with precision, enabling them to select a partner capable of meeting these specific demands.

Key selection criteria, including:

- Experience and expertise

- Technical skills

- Development methodology

- Support and maintenance

- Cost structure

are essential in identifying the right software development company. By meticulously evaluating potential partners through a structured comparison process, conducting thorough interviews, and checking references, organizations can ensure they choose a vendor that aligns seamlessly with their goals and values. This comprehensive approach not only streamlines the selection process but also significantly enhances the likelihood of a successful collaboration.

Once a company is chosen, establishing effective partnership and communication strategies becomes paramount. Critical steps in fostering a productive working relationship include:

- Defining roles

- Maintaining regular check-ins

- Utilizing collaboration tools

- Encouraging feedback

- Documenting processes

This commitment to collaboration and transparency is vital for navigating the complexities of financial software development, ensuring that projects are completed on time and adhere to the highest standards of quality and compliance. By embracing these best practices, you will pave the way for successful financial applications that drive business growth and innovation.

Frequently Asked Questions

What is financial application development?

Financial application development involves creating tools designed to manage financial transactions, reporting, and analytics.

Why is regulatory compliance important in financial software?

Financial software must comply with stringent regulations such as GDPR and PCI DSS, which vary by region and type of financial service. Compliance is crucial due to the increasing importance of regulatory adherence in financial technology, as highlighted by the projected growth of the RegTech market.

What security features are essential for financial applications?

Robust security measures, including encryption and secure access protocols, are essential due to the sensitive nature of financial data. Advanced security frameworks are necessary to adapt to emerging cyber threats in the fintech sector.

How does user experience (UX) impact financial software?

A user-friendly interface is vital for effective navigation, especially since users may lack technical expertise in finance. As competition increases, prioritizing UX becomes a key differentiator for financial service providers.

What are integration capabilities in financial applications?

Financial applications require connectivity with other systems, such as banking APIs, accounting programs, and CRM systems, to deliver a seamless experience. This interoperability is essential for creating a cohesive user experience and optimizing operational efficiency.

How can businesses define their scope and expectations when collaborating with software firms?

By thoroughly understanding regulatory compliance, security features, user experience, and integration capabilities, businesses can more accurately define their scope and expectations when working with software firms.