Overview

The article presents ten compelling benefits of fintech custom software development specifically tailored for SaaS owners. It asserts that personalized solutions significantly enhance operational efficiency, user experience, and security. By showcasing successful implementations and current trends within the fintech industry, the article illustrates that bespoke software not only complies with regulatory demands but also strategically positions firms for sustainable growth and a competitive edge in an ever-evolving market. This underscores the necessity for SaaS owners to consider custom software development as a vital investment in their future.

Introduction

Fintech is revolutionizing the financial landscape, with custom software development leading this transformation. For SaaS owners in the fintech sector, investing in tailored software solutions presents a wealth of advantages, including enhanced security and improved user experience. Yet, as competition intensifies, how can companies effectively leverage these benefits? This article explores the top ten advantages of fintech custom software development, illustrating how these bespoke solutions empower SaaS owners to excel in a rapidly evolving industry.

SDA: Tailored Custom Software Solutions for Fintech Success

SDA excels in fintech custom software development, delivering tailored software services specifically designed for financial technology firms to address their unique challenges and operational needs. By prioritizing user-centric design and integrating robust technology, SDA empowers financial institutions to innovate and significantly enhance their operational efficiency. This customized approach aligns every response with the strategic goals of clients, ensuring they achieve a in the rapidly evolving financial technology landscape.

Successful projects underscore the effectiveness of this strategy. For instance, a financial technology startup that outsourced its app development achieved a quicker time to market, launching ahead of competitors and gaining a substantial advantage. Similarly, companies that adopted real-time analytics in their financial applications reported a 45% improvement in user experience metrics, illustrating how customized approaches can enhance engagement and satisfaction. This aligns with findings from the case study on real-time analytics in financial mobile apps.

Looking ahead to 2025, trends indicate a growing emphasis on fintech custom software development as companies strive for speed and personalization in their offerings. Industry leaders recognize that investing in fintech custom software development enhances operational efficiency, fosters customer loyalty, and accelerates growth. As Hazel Watson aptly states, "Custom financial technology application development is more than a tech trend; it’s a growth engine."

The benefits of fintech custom software development in financial technology are manifold:

- Enhanced security through personalized architecture

- Improved user experiences leading to greater satisfaction

- The agility to respond swiftly to market demands

By leveraging tailored approaches in fintech custom software development, financial technology firms can navigate regulatory challenges and optimize their operations, positioning themselves for sustained success in an increasingly competitive environment. Furthermore, with the financial technology market projected to expand at a CAGR of 16.2% from 2024 to 2032, the importance of investing in fintech custom software development becomes even more critical.

AI Integration: Boosting Efficiency and User Experience

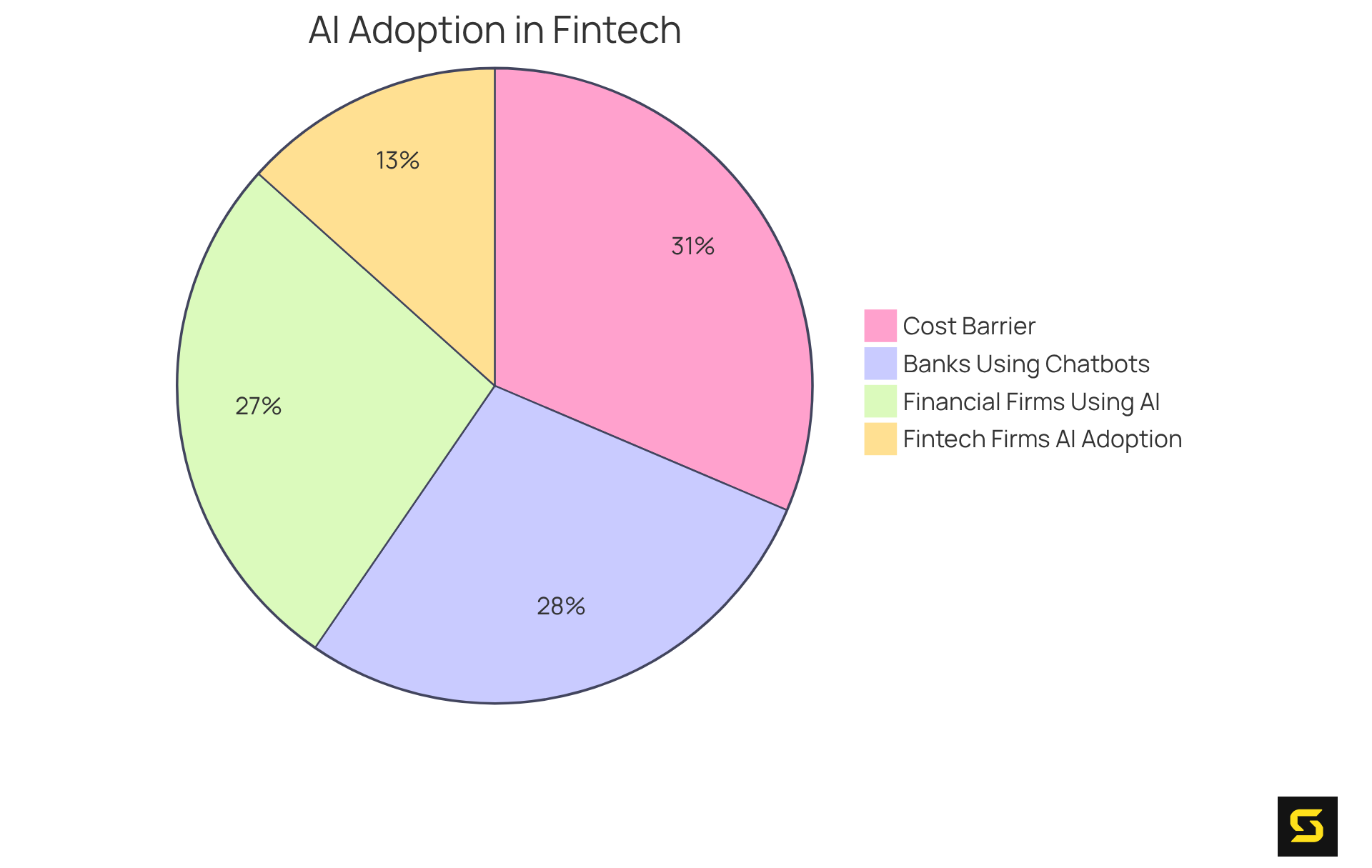

Integrating AI into financial technology applications dramatically enhances efficiency by automating routine tasks and delivering data-driven insights. AI algorithms analyze user behavior to provide personalized financial advice, significantly improving user engagement. Notably, 37% of financial technology firms have adopted AI for customer service, while 78% of banks utilize chatbots, showcasing the widespread adoption of AI tools in the financial sector.

Furthermore, AI streamlines compliance processes, alleviating the workload on human resources and enabling teams to concentrate on strategic initiatives. This shift not only but also fosters a more responsive and tailored user experience. In fact, 75% of financial firms now utilize AI technologies for various applications, including fraud detection and risk management.

As Manoj Chaudhary, CTO of Jitterbit, emphasizes, 'In financial technology, where trust and accuracy are paramount, AI must complement human judgment, not replace it.' However, it is crucial to acknowledge that 87% of firms cite the cost of AI implementation as a significant barrier, highlighting the challenges that accompany this transformative technology.

Enhanced Security: Custom Solutions for Financial Safety

Fintech custom software development empowers fintech firms to implement personalized security strategies that effectively address their unique challenges. These strategies encompass like AES-256, known for its resilience against cryptographic attacks, alongside multi-factor authentication (MFA), which significantly mitigates the risk of unauthorized access. Furthermore, real-time fraud detection systems harness AI-driven algorithms to scrutinize transaction patterns, facilitating the proactive identification of suspicious activities.

Essential to this framework is employee training on data handling and cyber threats, which bolsters overall security awareness within the organization. By enhancing data protection and ensuring compliance with regulations such as GDPR and PCI DSS, fintech custom software development not only safeguards sensitive information but also fosters customer trust—an indispensable factor for sustained success in the competitive financial sector.

Moreover, the adaptability of customized security measures allows them to scale alongside a business as transaction volumes increase, ensuring continuous protection. For instance, a leading financial technology firm successfully thwarted a cyber-attack by deploying a real-time monitoring system powered by AI, exemplifying the effectiveness of custom security measures in practice.

As the financial technology landscape evolves, fintech custom software development that includes tailored security measures becomes crucial for maintaining a robust defense against emerging threats, ultimately reducing the likelihood of costly security breaches and enhancing customer confidence.

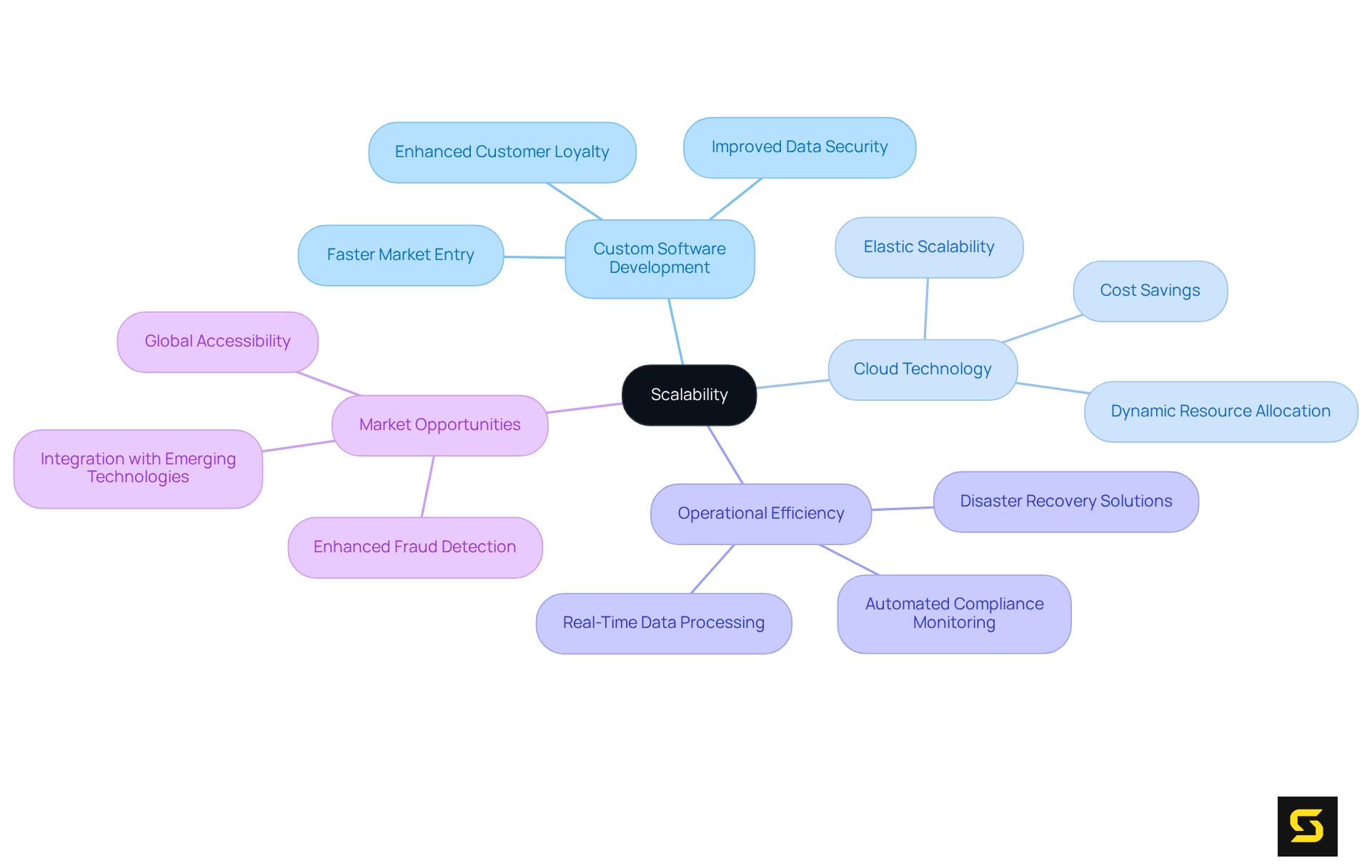

Scalability: Adapting to Business Growth with Custom Solutions

Fintech custom software development creates tailored financial technology systems that are crafted for effortless scalability, empowering companies to adapt seamlessly as they grow. This enables organizations to effectively manage increased transaction volumes and expanding user bases without compromising performance.

For example, cloud-based solutions can dynamically allocate resources in response to demand fluctuations, ensuring uninterrupted service during peak periods. Such capabilities are essential for companies engaged in fintech custom software development that are striving to enhance their market presence.

As industry leaders emphasize, the integration of cloud technology not only boosts operational efficiency but also stimulates innovation, allowing companies to respond swiftly to market changes. The ability to scale effectively positions firms specializing in fintech custom software development to seize emerging opportunities and maintain a competitive edge in a rapidly evolving landscape.

Improved User Experience: Designing for Customer Satisfaction

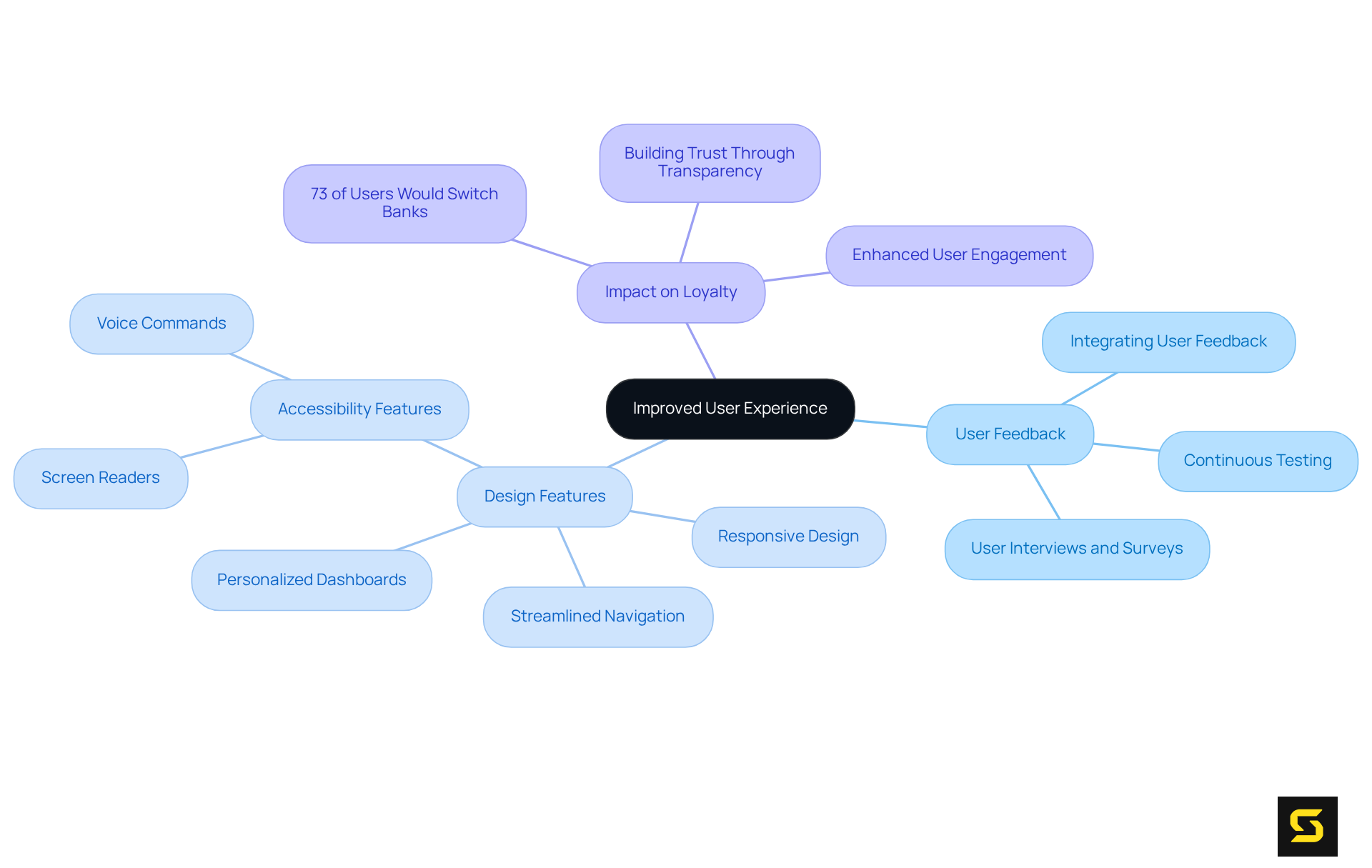

Fintech custom software development empowers financial technology firms to craft user interfaces that are not only intuitive but also meticulously tailored to their target audience. By actively integrating user feedback throughout the design process, organizations can guarantee their applications effectively meet customer needs. Features such as personalized dashboards, streamlined navigation, and responsive design are pivotal in enhancing user experience.

As Namrata Panchal notes, studies reveal that 70% of online businesses falter due to inadequate interface design, highlighting the critical need to prioritize usability. Furthermore, as Eric Izazaga emphasizes, fintech custom software development that embraces can significantly bolster customer loyalty, as 73% of users indicate they would switch banks for an improved digital experience.

By concentrating on these aspects, fintech companies can cultivate a more engaging and satisfying user journey, ultimately propelling long-term success.

Regulatory Compliance: Tailored Solutions for Legal Adherence

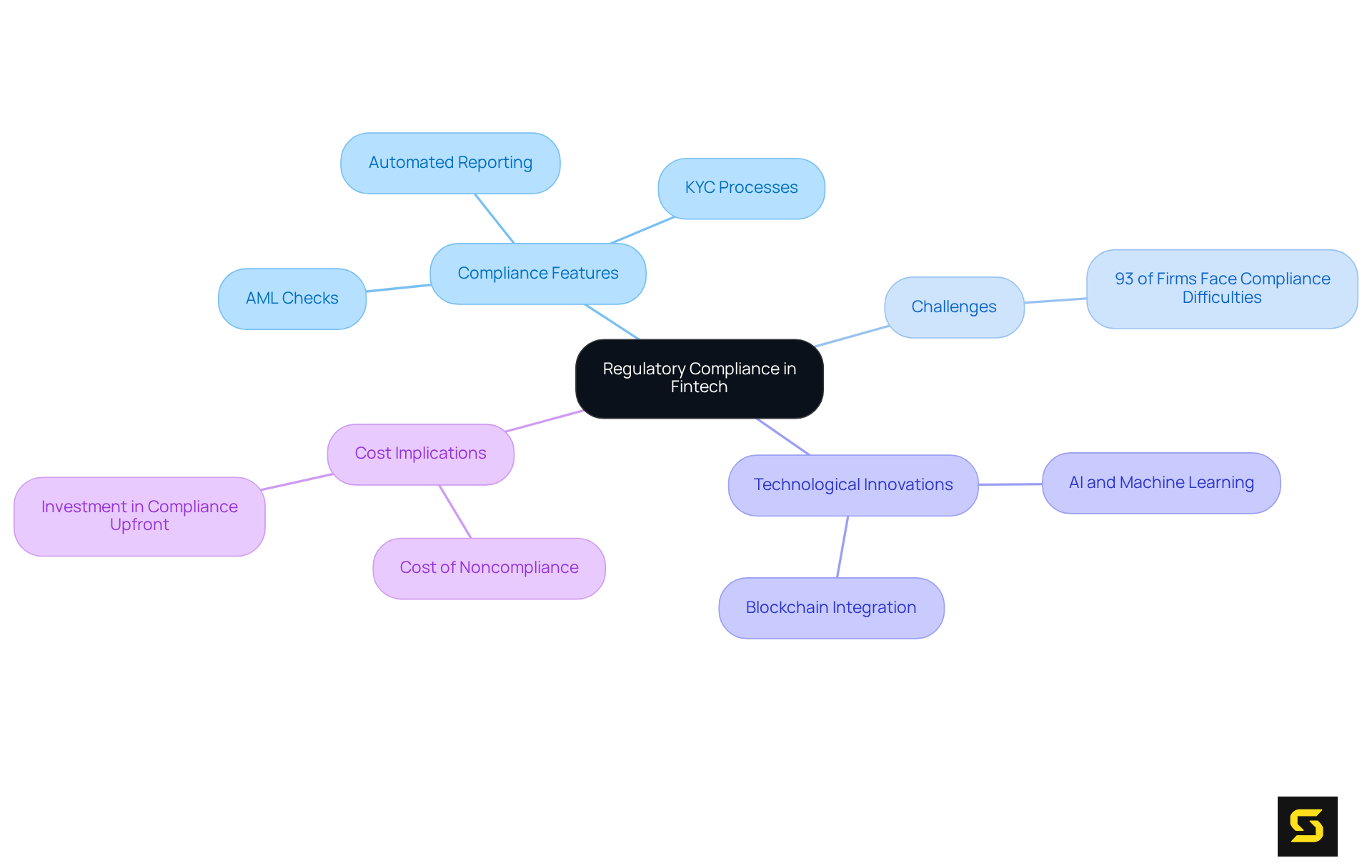

Fintech companies navigate a complex landscape of regulatory requirements that vary significantly by region and service type. Bespoke fintech custom software development can be meticulously designed to incorporate compliance features from the outset, ensuring adherence to legal obligations. These solutions often encompass:

- Automated reporting tools

- Streamlined KYC (Know Your Customer) processes

- Robust AML (Anti-Money Laundering) checks—essential elements for mitigating risks and avoiding substantial penalties.

Notably, 93% of financial technology firms encounter challenges in meeting compliance requirements, underscoring the complexities involved. The integration of AI and machine learning can significantly , with 84% of compliance experts in financial technology either utilizing or exploring these innovations for compliance.

Furthermore, as emphasized by industry experts, investing in compliance upfront proves far more cost-effective than addressing the repercussions of noncompliance, which can lead to fines exceeding millions of dollars. The compliance failures of Binance and Deutsche Bank serve as cautionary tales, illustrating the dire consequences of inadequate compliance measures.

Fintech custom software development encompasses tailored applications that not only fulfill regulatory standards but also enhance operational efficiency, ultimately fostering consumer trust and driving business growth.

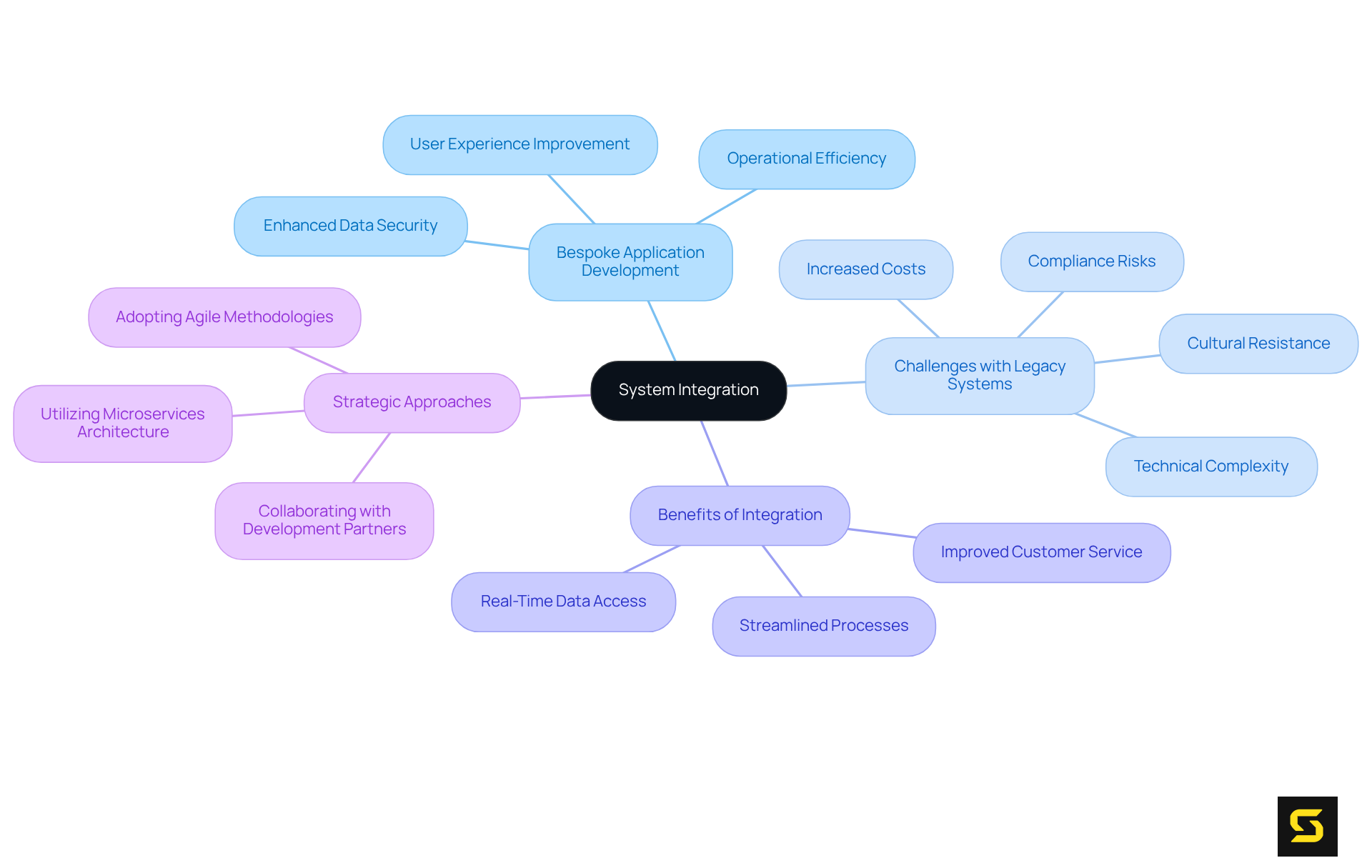

System Integration: Streamlining Operations with Custom Development

Bespoke application development, or [fintech custom software development](https://sda.company), is essential for financial technology firms aiming to connect their applications seamlessly with existing systems, including legacy banking solutions and external services. This integration fosters a cohesive operational environment where data flows effortlessly between systems, reducing silos and enhancing interoperability. Consequently, organizations can significantly boost operational efficiency and provide superior services to their customers.

Numerous banks face significant challenges when integrating financial technology with outdated systems, often leading to delays and increased costs. A 2024 survey revealed that 55% of banks consider legacy systems a major barrier to digital transformation. Tailored application solutions can bridge these gaps, facilitating smoother transitions and improved functionality. By leveraging microservices architectures, financial technology platforms can introduce new features, such as real-time payments, without overhauling their entire infrastructure, thereby ensuring business continuity.

The benefits of integrating legacy systems with customized software are substantial. Companies can attain greater operational efficiency, streamline customer-facing processes, and enhance data security. Moreover, leaders in the financial technology sector emphasize the importance of operational efficiency; as Serge Beck aptly noted, "The financial industry is at a crossroads, facing unprecedented pressure to adapt to the digital age."

Nevertheless, integrating legacy systems presents challenges, including technical complexity and cultural resistance. By prioritizing fintech custom software development, financial technology companies can modernize their operations and enhance their competitive position in a rapidly evolving market. This strategic approach enables them to respond swiftly to customer needs and regulatory demands, ultimately fostering trust and loyalty among users. To navigate these complexities effectively, SaaS product owners should consider .

Rapid Innovation: Staying Ahead in the Fintech Landscape

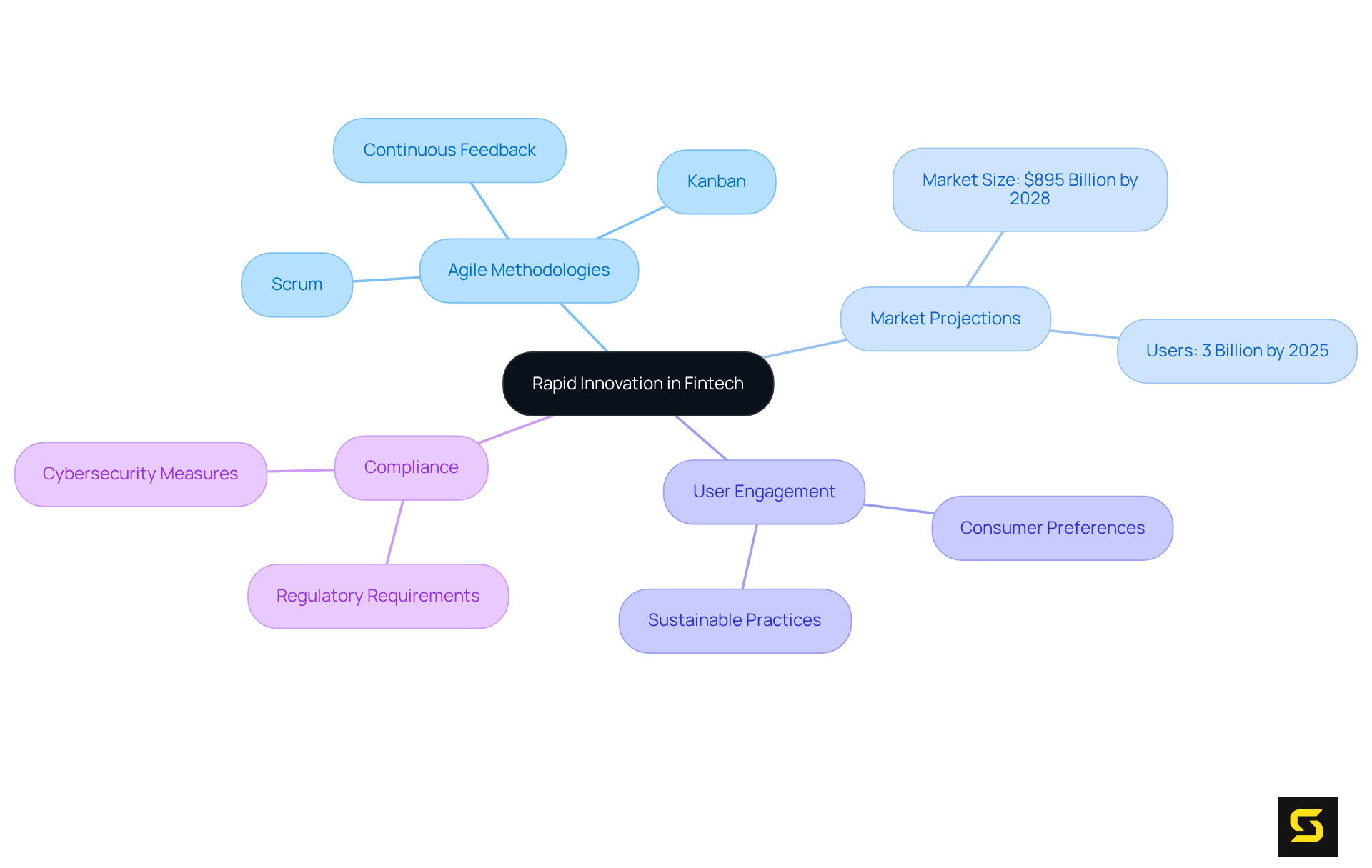

Tailored fintech custom software development solutions empower financial technology firms to innovate rapidly, enabling swift iterations and updates. This agility is essential in a landscape where evolve quickly. By leveraging agile development methodologies, fintech custom software development enables financial technology companies to respond effectively to market demands, ensuring they remain competitive and relevant.

The financial technology market size is projected to reach $895 billion by 2028, with users in this sector expected to hit 3 billion by 2025, underscoring the urgency for rapid adaptation. Agile practices such as Scrum and Kanban promote cross-functional collaboration, allowing teams to dynamically prioritize tasks and deliver features that closely align with user needs. Moreover, integrating continuous feedback loops into the development process enhances product quality and user satisfaction, ultimately leading to more successful outcomes.

As Juniper Research states, 'This surge is a sign of growing consumer engagement with environmental issues, encouraging more accountable and sustainable lifestyles.' Embracing agile methodologies not only streamlines project implementation but also fosters a culture of flexibility, which is vital for success in the fast-paced financial technology industry. Additionally, compliance with evolving regulations and robust cybersecurity measures are critical components that agile methodologies can help address within fintech custom software development, ensuring that fintech applications remain secure and compliant.

Cost-Effectiveness: Reducing Operational Expenses with Custom Solutions

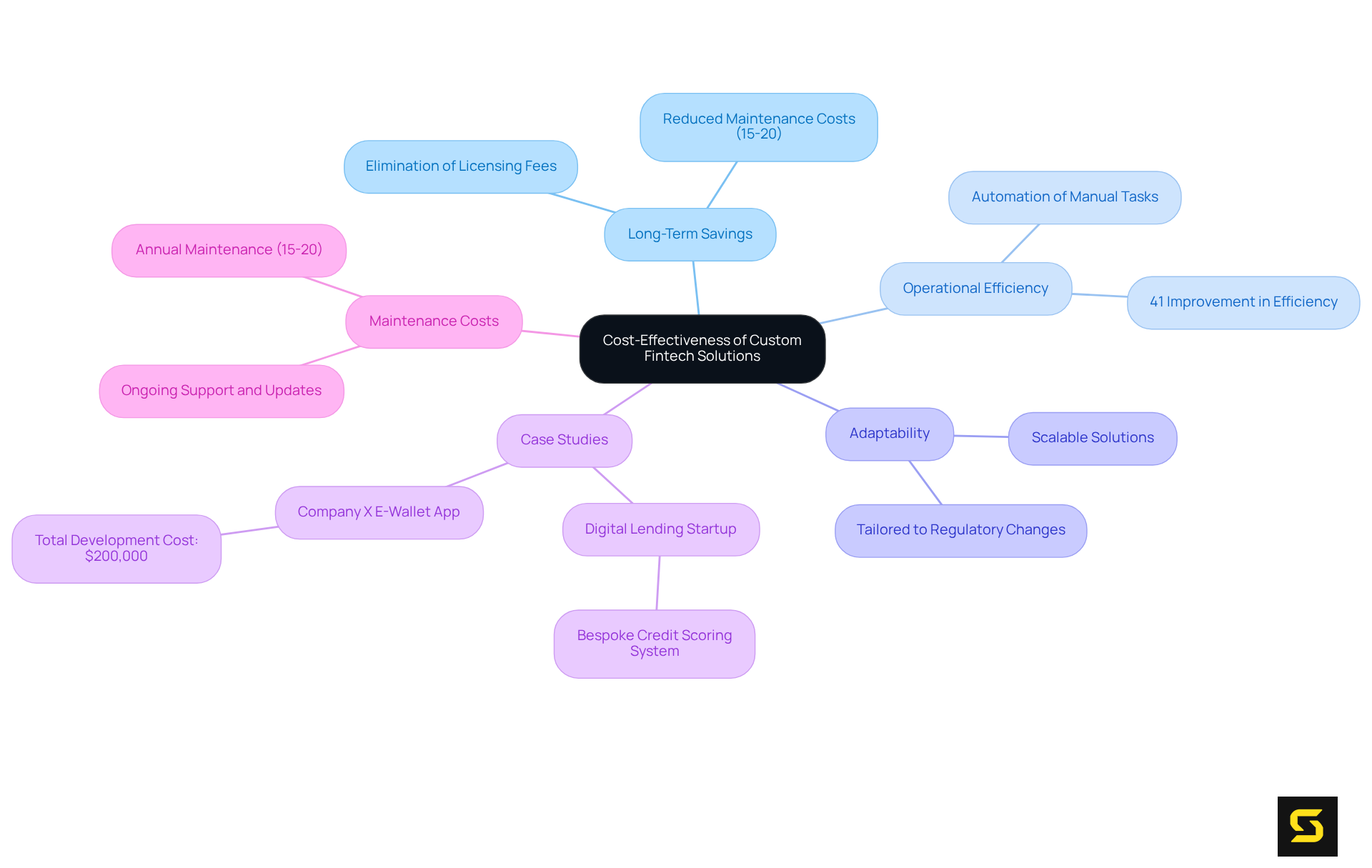

Investing in fintech custom software development may seem more expensive than opting for ready-made solutions, but the long-term savings can be substantial. Custom solutions created through fintech custom software development are meticulously crafted to streamline operations, automate manual tasks, and eliminate ongoing licensing fees that frequently accompany generic software. By boosting efficiency and alleviating operational bottlenecks, fintech companies can achieve a superior return on investment over time.

Consider the case of a digital lending startup in Southeast Asia that developed a bespoke credit scoring system through an innovative development strategy. This initiative not only met regulatory requirements but also improved operational efficiency by 41% and reduced tech maintenance costs by 35% within a year. Such customized strategies empower businesses to swiftly adapt to market changes and regulatory demands, ultimately leading to significant cost savings.

Financial analysts emphasize that organizations investing in tailored applications often witness considerable enhancements in efficiency and productivity. Alex Kugell remarked, "We have seen countless times that businesses that invest in custom solutions and software applications see significant improvements in efficiency and productivity." This observation is particularly relevant in the sector of fintech custom software development, where compliance and security are paramount. By focusing on core functionalities and automating processes, businesses can reduce manual labor and processing time, resulting in improved operational efficiency.

Furthermore, ongoing maintenance costs for financial technology applications typically range from 15% to 20% of the initial development expense annually. However, tailored applications can manage these costs more effectively, as their designs allow them to evolve alongside the business, minimizing the need for costly renovations or replacements.

In conclusion, while the initial investment in fintech custom software development may be higher, the long-term savings and operational efficiencies derived from personalized options make it a financially astute decision for SaaS owners striving to thrive in a competitive landscape. To fully leverage these advantages, SaaS product owners should contemplate adopting an that facilitates continuous feedback and adaptation, ensuring their software remains in sync with evolving business needs.

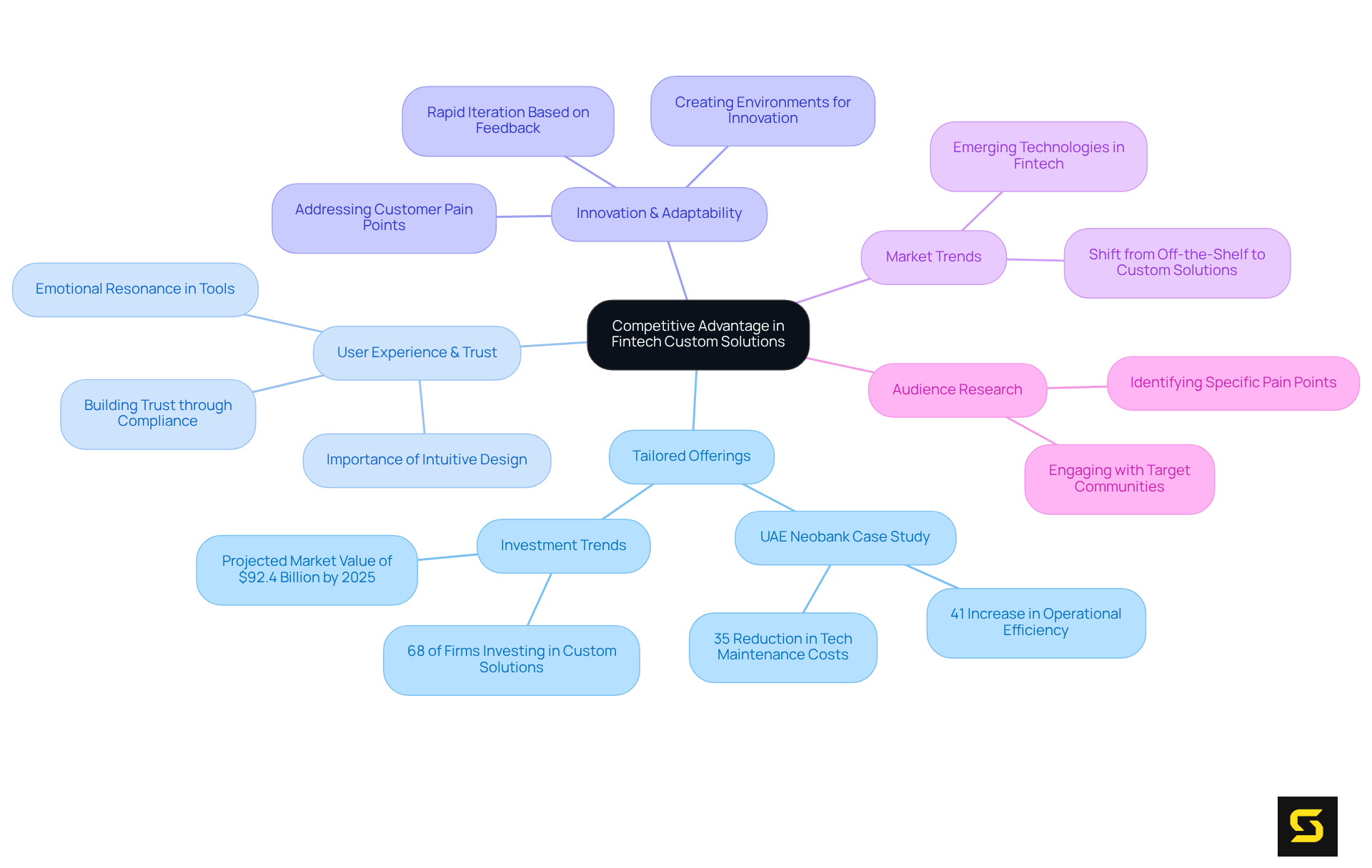

Competitive Advantage: Standing Out with Custom Fintech Solutions

Fintech custom software development allows tailored financial technology offerings to empower businesses to carve out a distinctive presence in a competitive marketplace, integrating unique attributes and functionalities often absent in standard products. This differentiation is crucial for attracting and retaining clients, as it allows financial technology companies to leverage proprietary technology tailored to their specific needs. For example, a UAE-based neobank transitioned to a custom-built platform, realizing a remarkable 41% increase in operational efficiency and a 35% reduction in tech maintenance costs by Q1 2025. Such outcomes highlight the transformative potential of fintech custom software development in driving growth and achieving market leadership.

Industry leaders assert that addressing customer pain points is vital for differentiation. Naresh Prajapati from Azilen Technologies emphasizes that prioritizing trust and compliance over mere disruption can set financial technology startups apart. Additionally, creating a seamless user experience through intuitive design is imperative; as Oleg Levitas from Pravda SEO Inc. notes, making financial technology more relatable with emotionally resonant tools can significantly enhance user engagement.

In a crowded market, the capacity to innovate and adapt swiftly is essential. Fintech startups that launch rapidly and iterate based on user feedback can build credibility and attract investors, as Dr. Clemen Chiang from Spiking points out. This strategy not only cultivates customer loyalty but also positions companies to respond adeptly to shifting market demands.

Moreover, with over 68% of financial firms planning to invest in fintech custom software development instead of off-the-shelf solutions in the coming year, the trend towards personalization is unmistakable. The global market for fintech custom software development is projected to reach $92.4 billion by the end of 2025, highlighting the significance of investing in bespoke solutions.

Ultimately, the in personalized financial software enhances fintech custom software development, as it not only differentiates products but also unveils new value, ensuring sustained growth and success in the financial technology landscape. To fully capitalize on these advantages, fintech startups must conduct comprehensive audience research to pinpoint specific pain points and tailor their offerings accordingly.

Conclusion

Fintech custom software development is not just a strategy; it is an essential cornerstone for SaaS owners in the financial technology sector, delivering bespoke solutions that adeptly tackle industry-specific challenges. By emphasizing customization, these solutions empower firms to enhance operational efficiency, elevate user experiences, and adeptly navigate the intricacies of regulatory compliance. This tailored approach not only fosters innovation but also equips companies to respond swiftly to market demands, thereby securing a competitive edge in an ever-evolving landscape.

Throughout this discussion, we have underscored the key benefits of fintech custom software development, including:

- Enhanced security measures

- Improved scalability

- Integration of AI for superior user engagement

Real-world examples have illustrated how businesses have successfully harnessed custom solutions to achieve remarkable operational improvements and significant cost savings. As the financial technology market continues to expand, the importance of investing in tailored software solutions becomes increasingly clear, with projections indicating substantial growth in the coming years.

In light of these insights, it is imperative for SaaS product owners to recognize the transformative potential of fintech custom software development. By embracing tailored solutions, companies can not only meet the unique needs of their clients but also drive sustainable growth and innovation. The future of fintech depends on the ability to adapt and innovate, making the adoption of custom software not merely a strategic advantage but a necessity for success in the competitive financial landscape.

Frequently Asked Questions

What is SDA's focus in custom software development?

SDA specializes in fintech custom software development, providing tailored software services designed to meet the unique challenges and operational needs of financial technology firms.

How does SDA's approach benefit financial institutions?

By prioritizing user-centric design and integrating robust technology, SDA empowers financial institutions to innovate and enhance operational efficiency, aligning solutions with clients' strategic goals for a competitive edge.

Can you provide an example of a successful project by SDA?

A financial technology startup that outsourced its app development to SDA achieved a quicker time to market, launching ahead of competitors and gaining a substantial advantage.

What improvements have companies seen from real-time analytics in financial applications?

Companies that adopted real-time analytics reported a 45% improvement in user experience metrics, enhancing engagement and satisfaction.

What are the projected trends for fintech custom software development by 2025?

There is a growing emphasis on speed and personalization in fintech offerings, with industry leaders recognizing that investing in custom software development enhances operational efficiency, customer loyalty, and growth.

What are some benefits of fintech custom software development?

Benefits include enhanced security through personalized architecture, improved user experiences leading to greater satisfaction, and the agility to respond swiftly to market demands.

How does AI integration impact financial technology applications?

AI integration enhances efficiency by automating routine tasks, delivering data-driven insights, and providing personalized financial advice, significantly improving user engagement.

What percentage of financial technology firms have adopted AI for customer service?

37% of financial technology firms have adopted AI for customer service, while 78% of banks utilize chatbots.

What challenges do firms face when implementing AI?

87% of firms cite the cost of AI implementation as a significant barrier to adopting this transformative technology.

How does fintech custom software development enhance security?

It allows fintech firms to implement personalized security strategies, including advanced encryption protocols, multi-factor authentication, and real-time fraud detection systems.

Why is employee training important in cybersecurity for fintech firms?

Employee training on data handling and cyber threats enhances overall security awareness within the organization, bolstering data protection and compliance with regulations.

What role does adaptability play in customized security measures?

Customized security measures can scale alongside a business as transaction volumes increase, ensuring continuous protection against emerging threats.