Overview

The article titled "7 Essential Fintech App Development Services for SaaS Owners" asserts the necessity of identifying critical services that SaaS owners must consider when developing fintech applications. It underscores the significance of:

- Tailored software solutions

- Adherence to regulatory compliance

- User-centric design

- Integration of advanced technologies

These elements are pivotal in not only ensuring successful fintech app development but also in enhancing user engagement. By recognizing and implementing these services, SaaS owners can position themselves for success in the competitive fintech landscape.

Introduction

The financial technology sector is witnessing an extraordinary surge, with projections forecasting a significant growth trajectory that could propel the market from $44.52 billion in 2024 to $53.95 billion in 2025. This rapid evolution offers a unique opportunity for SaaS owners to leverage fintech app development services, crafting innovative solutions that not only meet regulatory standards but also elevate user engagement. However, as competition intensifies, the challenge lies in pinpointing which essential services will genuinely drive success in this dynamic environment.

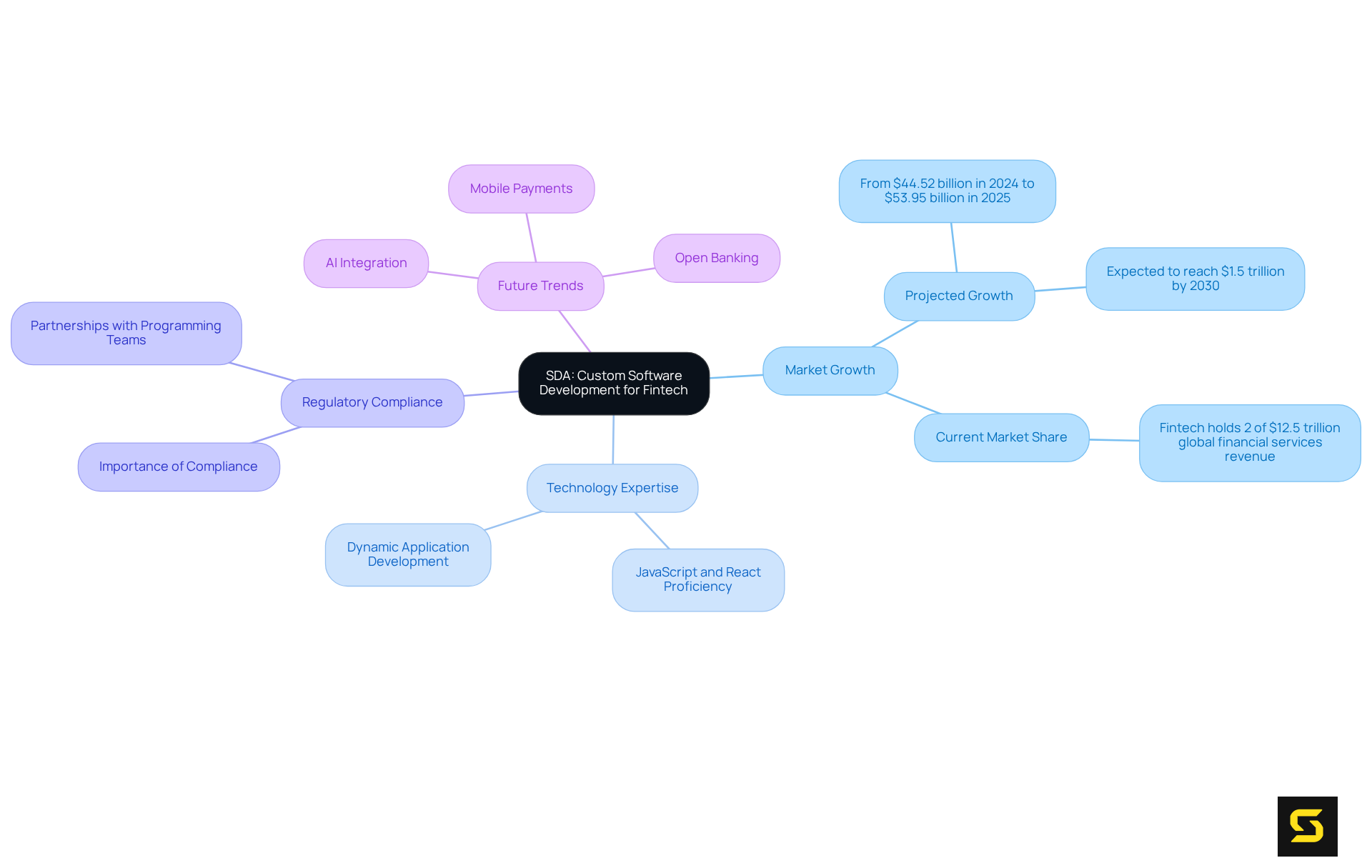

SDA: Custom Software Development for Fintech Applications

[SDA](https://sda.company) stands at the forefront of tailored software solutions for financial technology, providing [fintech app development services](https://nearsure.com/blog/how-can-custom-software-development-solutions-benefit-fintech) that seamlessly integrate cutting-edge technology with strategic insight. This approach guarantees that our solutions not only meet regulatory standards but also significantly boost user engagement.

With the financial technology software market projected to grow from $44.52 billion in 2024 to $53.95 billion in 2025, and in annual revenue by 2030, the demand for robust solutions is on the rise.

SDA leverages its expertise in JavaScript and React to provide fintech app development services that craft dynamic applications tailored to the specific needs of financial technology companies, empowering them to excel in a competitive landscape.

As regulatory compliance gains importance, financial technology professionals emphasize the necessity of partnering with programming teams that understand these complexities.

Looking ahead to 2025, key trends such as:

- AI integration

- Mobile payments

- Open banking

will influence the future of fintech app development services. It is imperative for companies to embrace agile methodologies and innovative solutions to maintain a competitive edge.

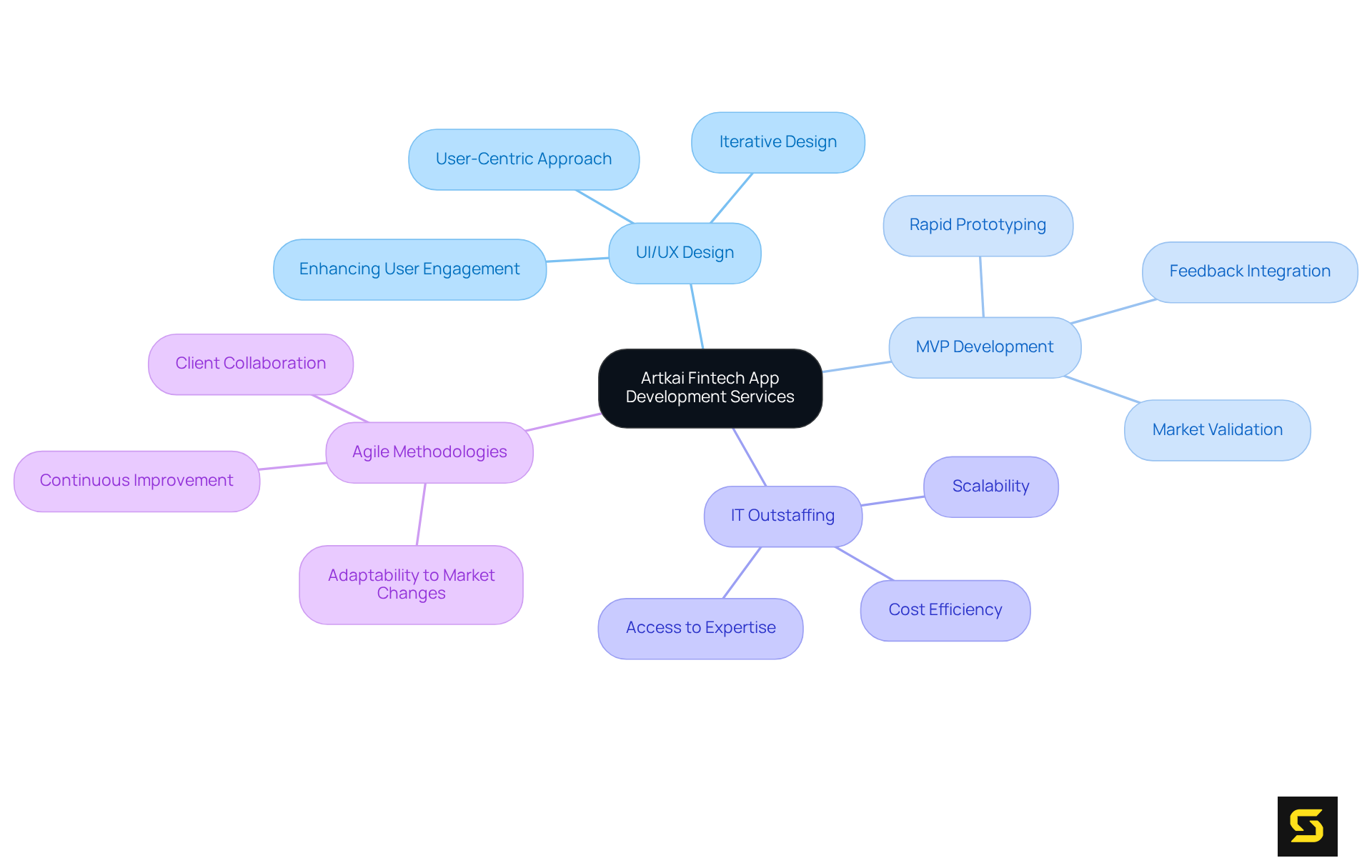

Artkai: Comprehensive Fintech App Development Services

Artkai provides a comprehensive suite of fintech app development services, which includes UI/UX design, MVP development, and IT outstaffing. Central to their approach is a commitment to client-focused design, ensuring that applications are not only functional but also engaging and intuitive for users. A prime example is the iFunded project, which simplifies complex financial processes, rendering them accessible and transparent. By employing agile methodologies, Artkai provides fintech app development services that are adaptable to evolving market demands, establishing themselves as a reliable partner for SaaS owners aiming to innovate in the financial technology landscape.

As we approach 2025, user-focused design in fintech solutions is increasingly vital, as consumers expect seamless experiences. Current best practices underscore the importance of iterative design, where continuous feedback is integrated to refine and enhance applications. This approach not only boosts client satisfaction but also —an essential component in the financial services sector. As Sergii Steshenko, CEO & Co-Founder, aptly states, "People now expect payments to be instant, apps to be intuitive, and security to be a given."

Industry leaders assert that embracing agile practices enables financial technology firms to remain competitive by swiftly adapting to regulatory shifts and client needs. The statistic that 42% of startups fail due to a lack of product and market fit underscores the necessity of user-centric approaches and iterative design in the creation of financial technology. As the financial technology sector continues to evolve, prioritizing user experience will be critical for driving engagement and retention.

Binmile: Fintech App Development Cost Breakdown

Binmile provides an in-depth analysis of the expenses associated with fintech app development services, which typically include:

- Design

- Construction

- Testing

- Maintenance

The complexity of features, the technology stack utilized, and the geographical location of the development team are critical factors that can significantly influence overall costs. By understanding these components, SaaS owners can strategically plan their budgets and allocate resources more effectively for their fintech app development services. This knowledge empowers them to , ensuring the success of their initiatives.

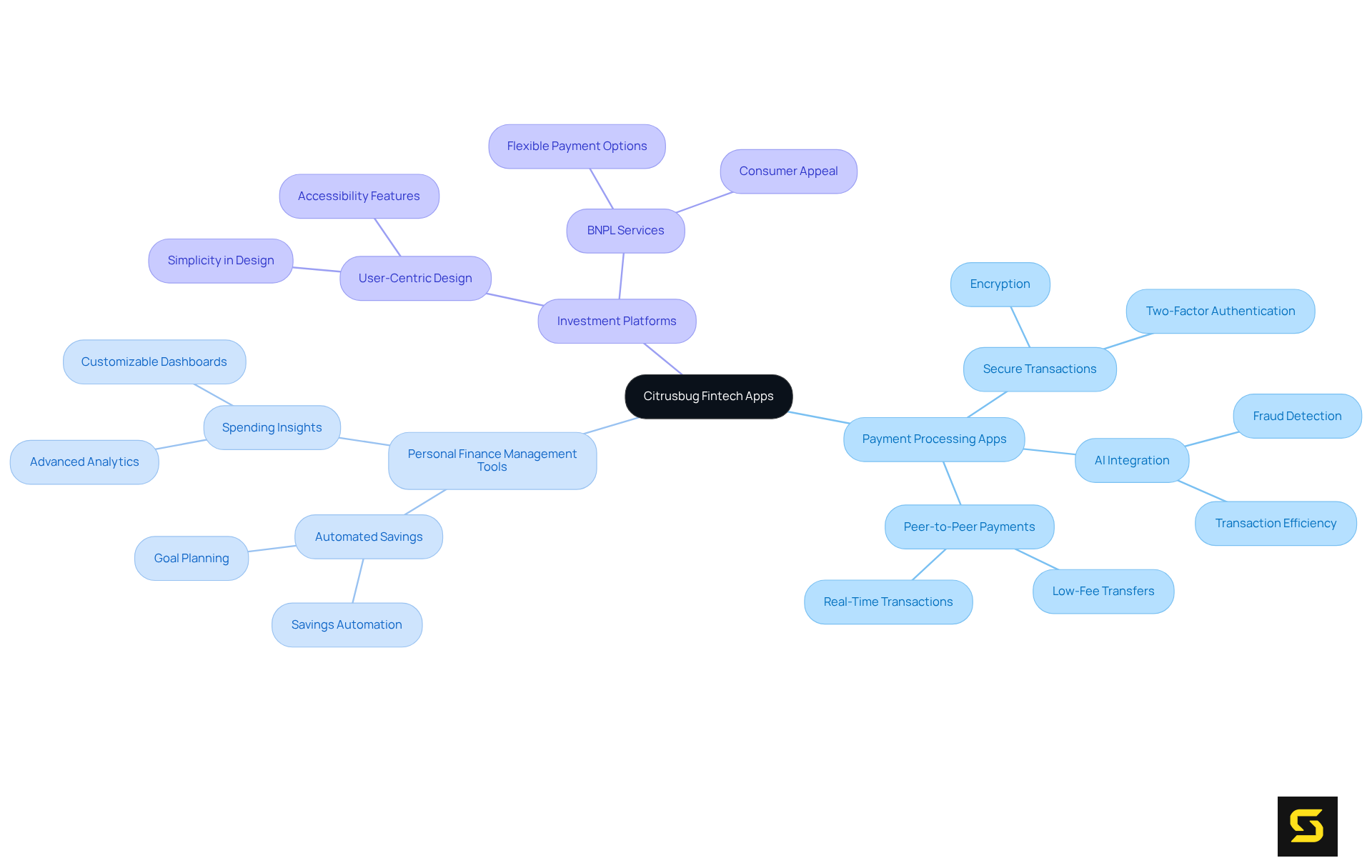

Citrusbug: Types and Features of Fintech Apps

Citrusbug highlights various fintech app development services, such as payment processing apps, personal finance management tools, and investment platforms. Each category is equipped with distinct features tailored to meet specific individual needs. Notably, payment processing applications focus on secure transactions, leveraging advanced technologies such as encryption and two-factor authentication to foster trust among users. As the payment processing landscape evolves, key trends for 2025 point to a marked shift towards mobile payments and digital wallets. Projections indicate that within five years, half of today’s smartphone owners will favor these methods. This transition emphasizes the imperative for SaaS owners to utilize to create applications that not only facilitate transactions but also deliver insights into spending and saving habits through sophisticated analytics.

Effective features in payment processing applications include peer-to-peer payment options, which offer low-fee, real-time fund transfers, and automated savings solutions that encourage regular saving habits. Moreover, the integration of AI for fraud detection and transaction efficiency is becoming essential for maintaining security and enhancing customer satisfaction. Security remains a critical component of financial applications, where safeguarding individual data is paramount for establishing trust. Implementing strategies like encryption and two-factor authentication bolsters confidence and cultivates a reliable application.

Industry experts underscore the significance of user-centric design, advocating for simplicity and accessibility in app functionalities. Tom Creighton asserts that 'simplicity in design aids individuals in swiftly accessing essential tools and functionalities.' By prioritizing these elements, SaaS proprietors can craft solutions that not only meet but exceed client expectations, ultimately boosting engagement and loyalty in a competitive marketplace. Additionally, the rising popularity of buy now, pay later (BNPL) services is reshaping consumer expectations, highlighting the necessity for fintech app development services that can effectively respond to evolving payment preferences. The surge in electronic payment methods may also precipitate the decline of paper currency, further underscoring the urgency for SaaS owners to adapt to these emerging trends.

Dev Technosys: Advanced Features for Fintech Apps

Incorporating advanced features into fintech app development services is essential for enhancing functionality and client engagement. AI-driven analytics serve a pivotal role by delivering actionable insights that empower individuals to make informed financial decisions. For instance, these analytics can identify spending trends, forecast future expenses, and offer personalized suggestions, thereby enriching the user experience. Industry experts point out that approximately 95% of new products fail, highlighting the critical need for these innovations to achieve success in a competitive market.

Real-time transaction monitoring stands out as another vital feature that guarantees security and transparency. By continuously overseeing transactions, financial technology applications can swiftly detect fraudulent activities, providing users with peace of mind. This capability not only safeguards users but also in the application. Financial technology innovators face challenges such as regulatory hurdles and cybersecurity threats, making it imperative to utilize fintech app development services to implement robust features like real-time monitoring.

Furthermore, the integration of AI-driven analytics and real-time monitoring enables SaaS owners to carve out competitive advantages through fintech app development services. Jeff Bezos emphasizes the importance of a customer-centric innovation strategy, aligning perfectly with the utilization of these technologies to effectively meet client needs. By nurturing user loyalty and differentiating their offerings in a saturated market, SaaS owners can catalyze business growth. As the financial technology sector continues to evolve, embracing such advanced features will be crucial for fulfilling consumer demands and ensuring long-term success.

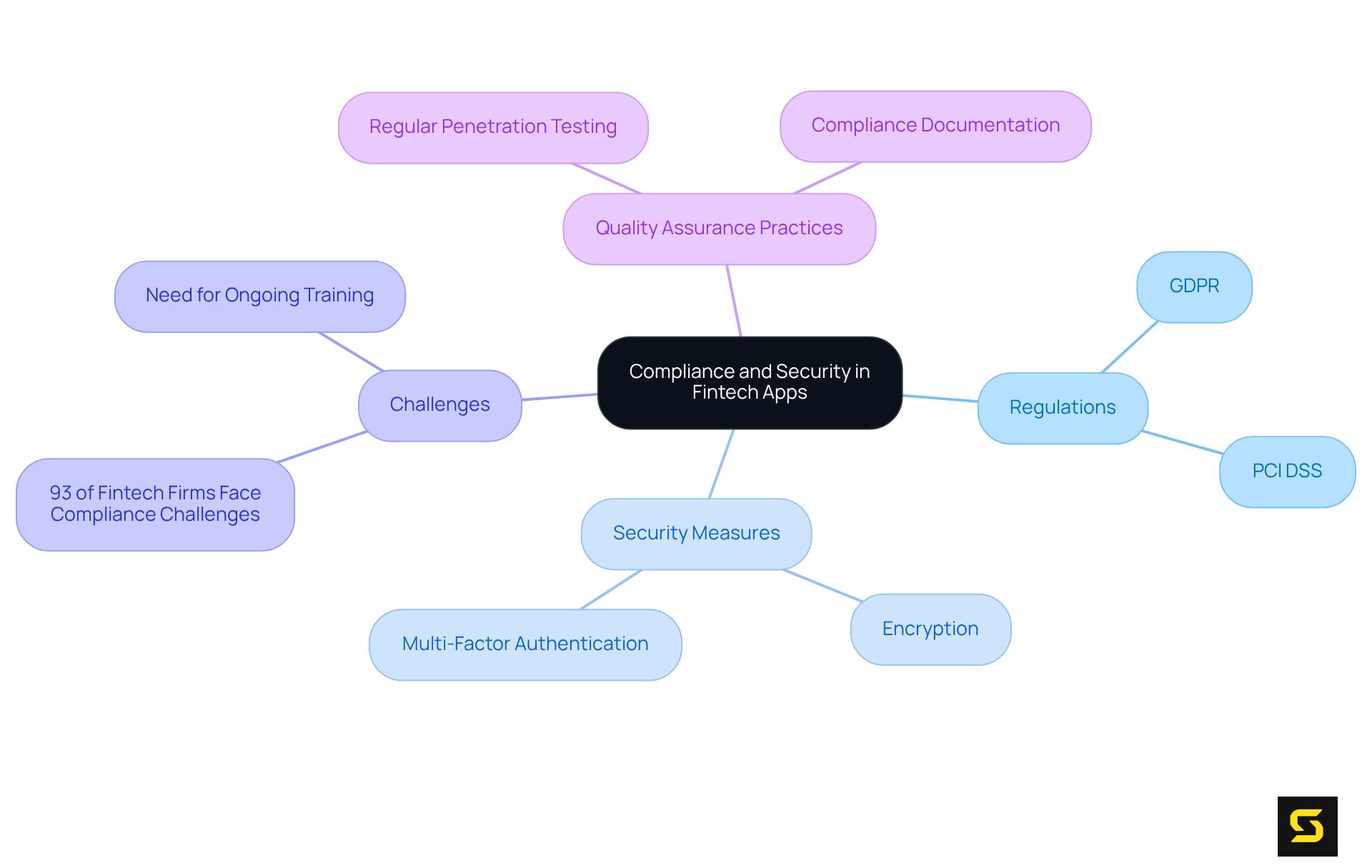

Indian App Developers: Compliance and Security in Fintech Apps

In the fintech landscape, fintech app development services prioritize compliance and security as paramount. Adhering to regulations such as GDPR and PCI DSS is essential for safeguarding personal information and fostering trust among clients. Implementing robust security measures—encryption and multi-factor authentication—is critical for protecting sensitive information against potential breaches.

Cybersecurity expert Rick Stevenson asserts, "Quality assurance helps identify and prevent compliance issues before they impact users, as well as provides the documentation necessary to demonstrate regulatory adherence." Moreover, a staggering 93% of financial technology firms encounter challenges in meeting compliance requirements, underscoring the urgent need for SaaS owners to prioritize these aspects. Continuous compliance proves beneficial, with 77% of organizations reporting an excellent or very good compliance rating. Additionally, ongoing training for compliance staff is vital to ensure adherence to regulations.

Quality assurance teams are instrumental in , thereby ensuring that fintech app development services maintain the security of financial technology applications. By incorporating these practices, financial technology firms can adeptly navigate the intricate regulatory environment while preserving client confidence and operational integrity.

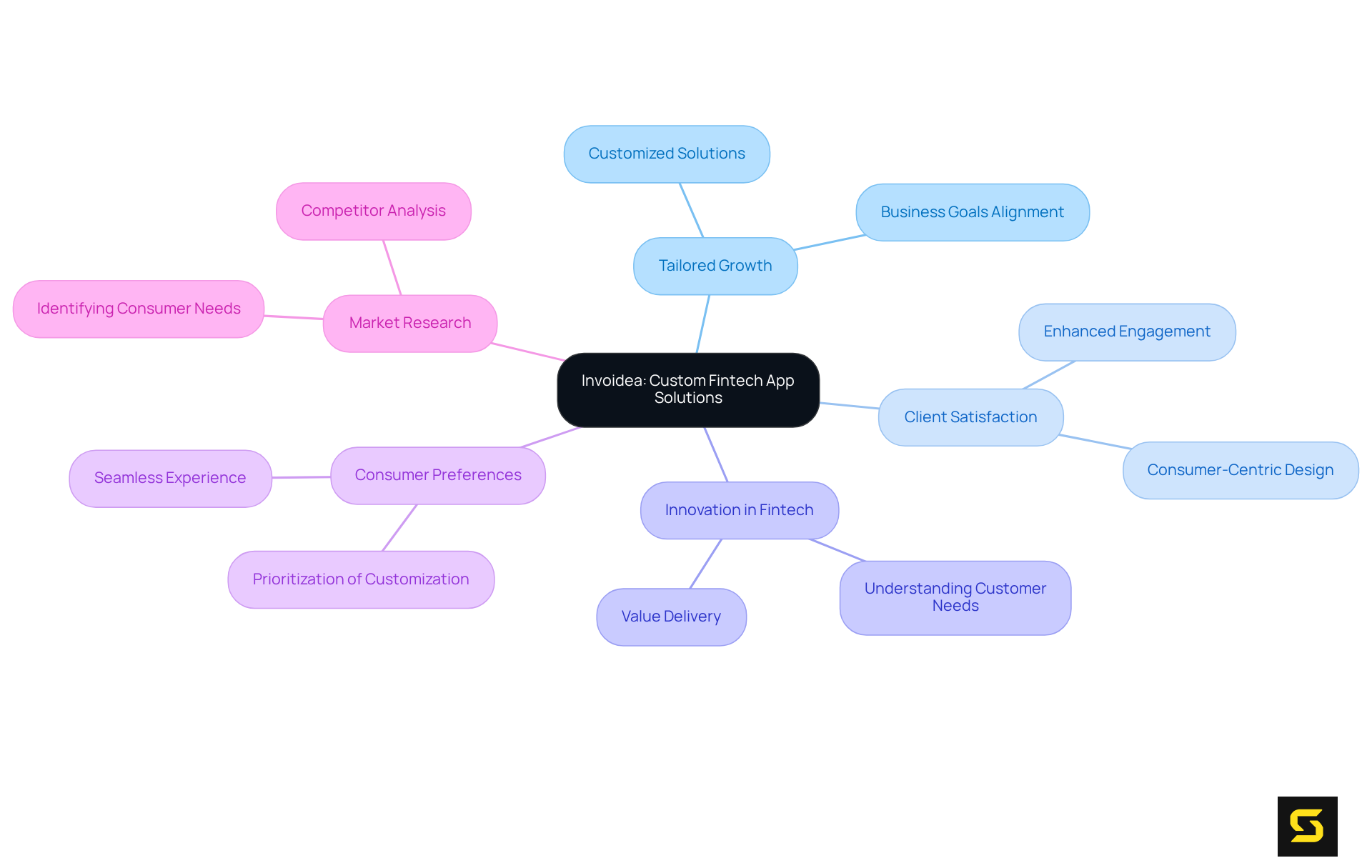

Invoidea: Custom Fintech App Solutions

Invoidea stands out as a leader in providing fintech app development services that are meticulously tailored to the distinct needs of businesses. By emphasizing tailored growth, they develop solutions that not only achieve specific business goals but also resonate with individual preferences. This approach significantly enhances , as the applications are thoughtfully designed with the end consumer in mind.

Industry leaders assert that innovation in financial technology hinges on a deep understanding of customer needs and the delivery of value through customized solutions. Organizations that implement tailored growth strategies frequently report improved client retention rates and heightened engagement metrics. Notably, recent statistics reveal that 80% of financial technology consumers prioritize a seamless experience over interest rates when selecting providers, underscoring the critical importance of personalized development.

SaaS proprietors should consider partnering with suppliers like Invoidea to utilize fintech app development services that create bespoke solutions, differentiating them in the competitive financial technology landscape and ultimately fostering growth and customer loyalty. Furthermore, conducting thorough market research to identify consumer needs can further enhance the effectiveness of these customized solutions.

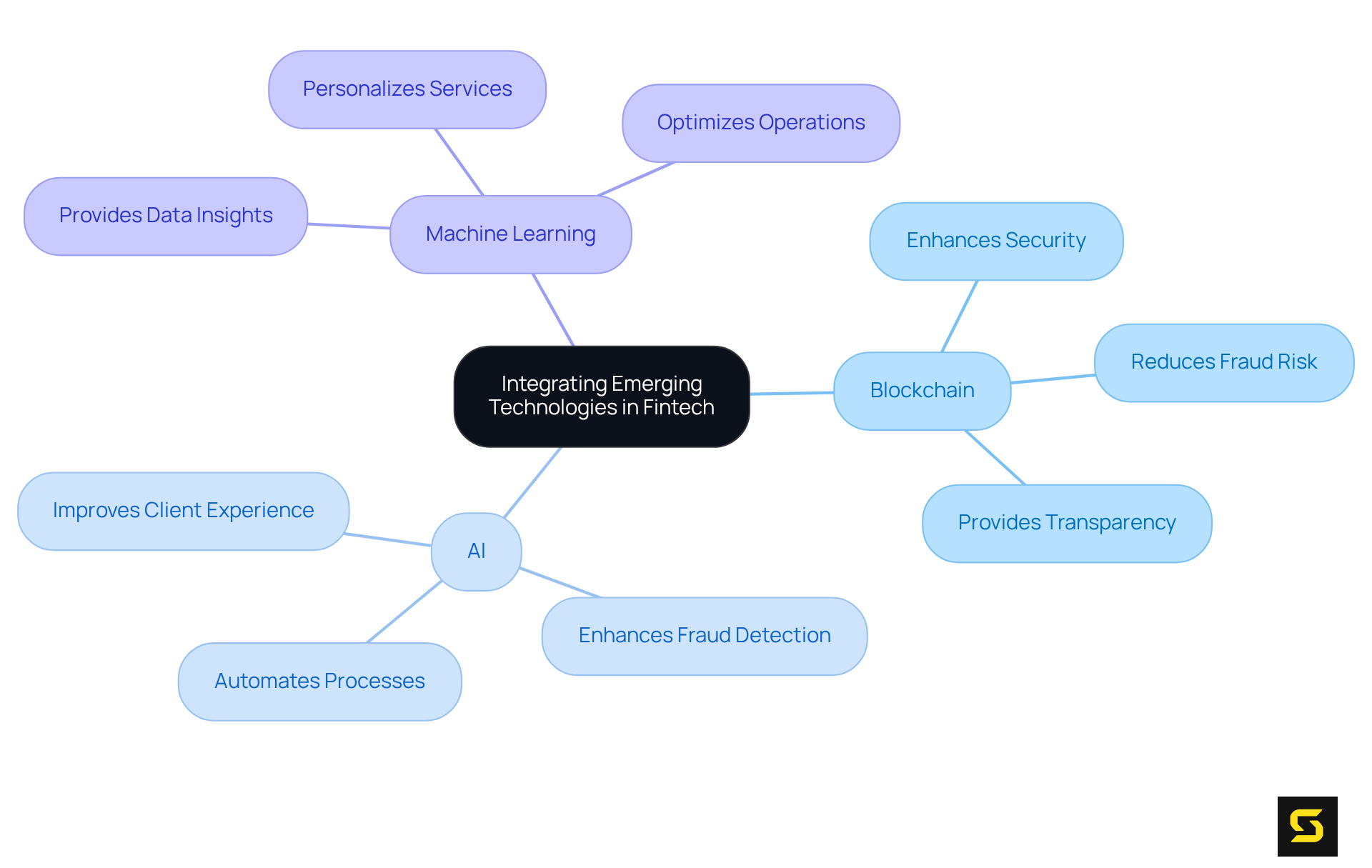

Technobrains: Integrating Emerging Technologies in Fintech Apps

Technobrains asserts the critical importance of integrating emerging technologies such as blockchain, AI, and machine learning into fintech solutions. These innovations not only enhance security but also significantly improve client experience and yield valuable insights through data analytics. By fully embracing these advancements, SaaS owners can create applications that are not only more efficient but also more effective, adeptly addressing the evolving demands of clients and the market. To remain competitive, it is essential to leverage these technologies for .

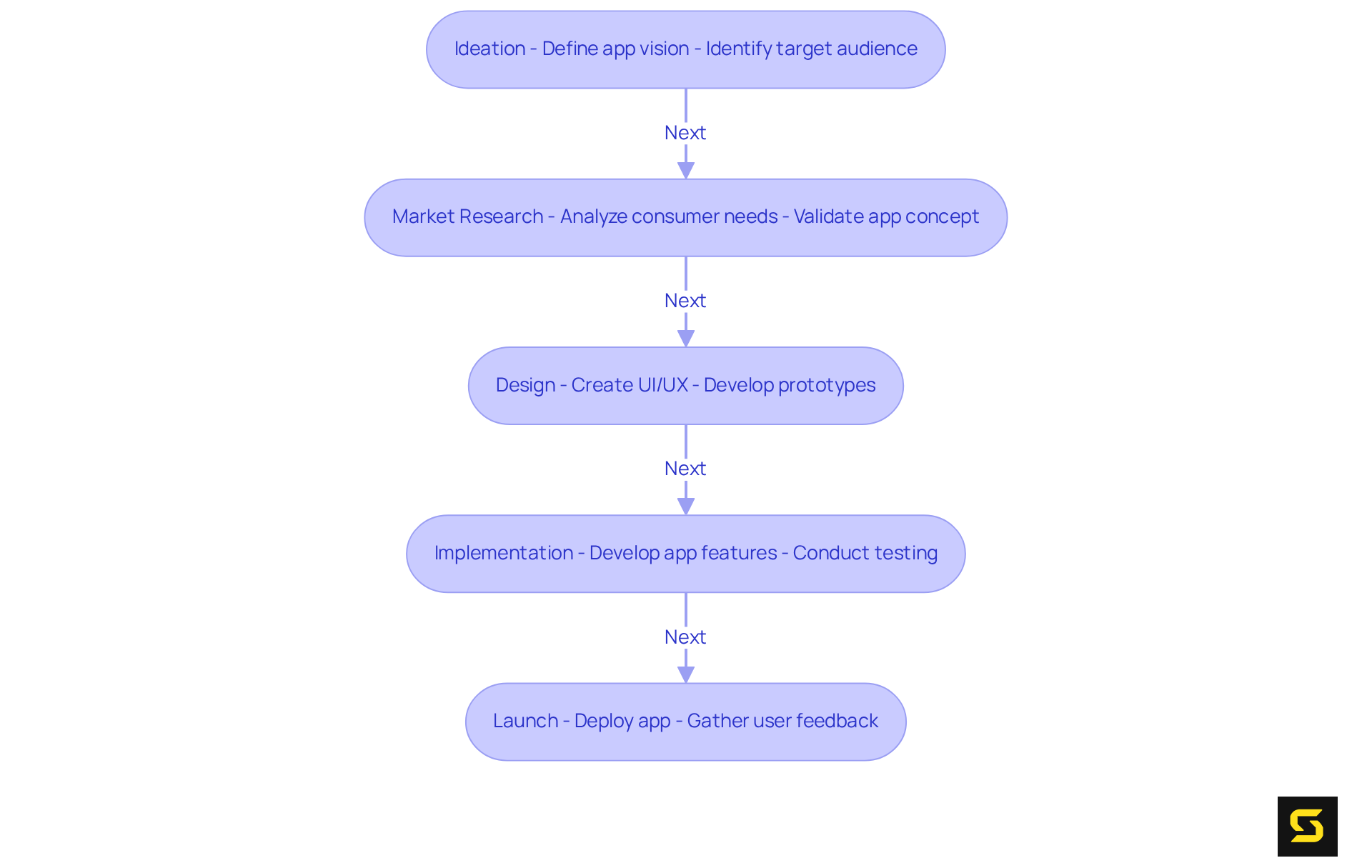

SmartOSC: Step-by-Step Guide to Fintech App Development

SmartOSC provides comprehensive fintech app development services through a step-by-step manual for creating financial technology applications, covering key phases from ideation and market research to design, implementation, and launch. Each stage is critical to ensuring that the final product meets client needs and aligns with business objectives. By following this structured approach, SaaS owners can streamline their development processes and significantly increase their chances of success in the competitive financial technology landscape by utilizing fintech app development services.

Market analysis is a pivotal component of this process, as it identifies consumer needs and market gaps, ultimately guiding the creation of a product that resonates with its target audience. Statistics reveal that nearly 75% of consumers favor personalized services, highlighting the necessity for thorough market analysis to effectively tailor offerings. Furthermore, the digital payments sector is projected to exceed 5 billion users by 2026, underscoring the expanding market potential for financial technology applications.

Successful financial technology companies frequently leverage market research to validate their concepts before engaging in fintech app development services on a large scale. For example, Robinhood incorporated user feedback during its MVP phase to refine its investment platform, which contributed to its rapid growth and appeal among younger investors. Similarly, Chime's emphasis on user-centric features was informed by extensive market research, enabling it to secure a significant share of the digital banking sector.

Industry leaders underscore the vital role of market research in financial technology. Alona O. asserts, "Starting the financial technology software creation journey begins with market research," emphasizing its foundational importance. Additionally, understanding market dynamics and consumer preferences can substantially reduce the risk of costly mistakes during the fintech app development services process. The typical cost of creating a financial technology application ranges from $30,000 to $350,000, making it essential to validate concepts prior to substantial investment.

By prioritizing market research, SaaS owners can enhance their development processes with fintech app development services, ensuring that their financial technology solutions not only comply with regulatory standards but also deliver exceptional user experiences. This strategic focus on is crucial for thriving in the competitive financial technology arena.

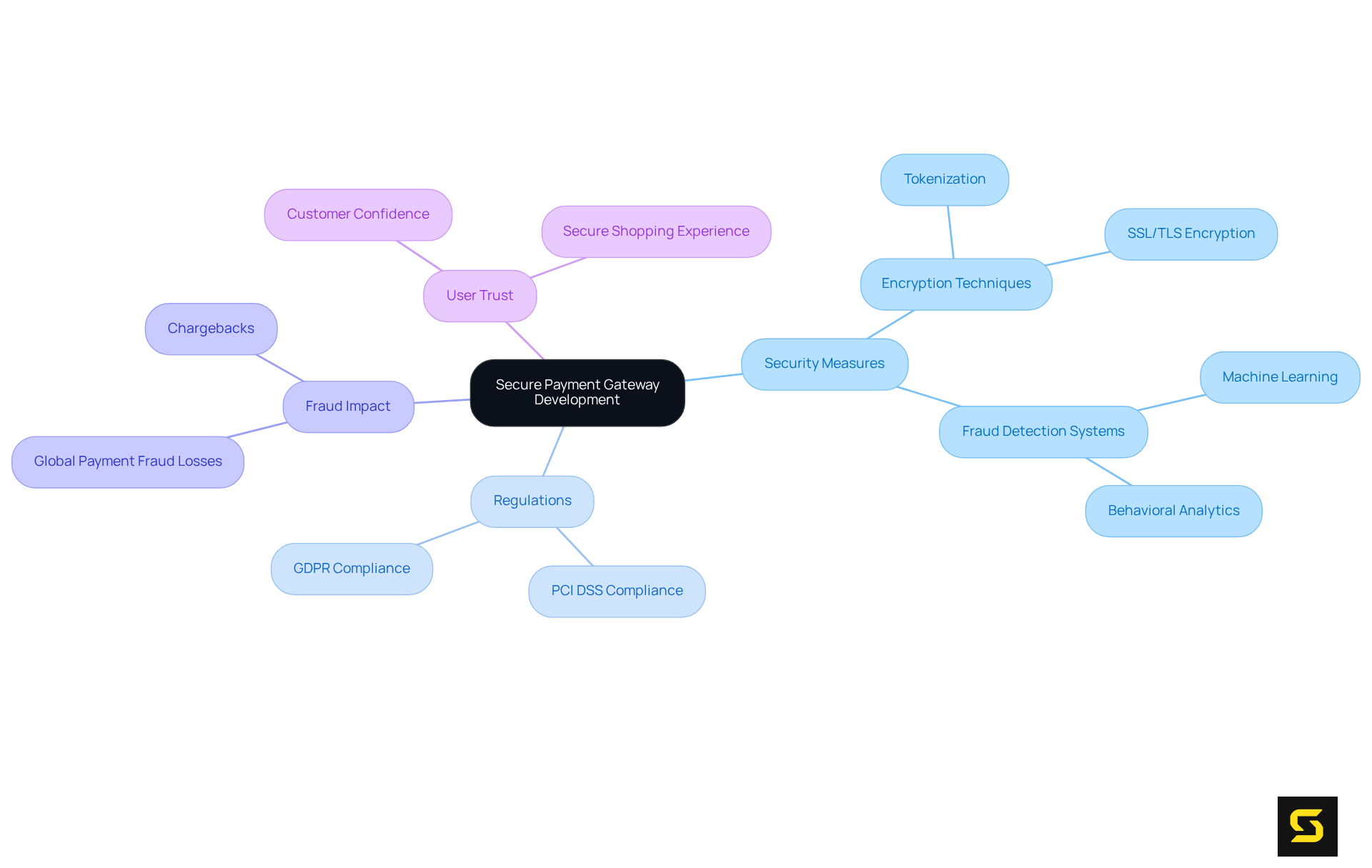

Successive Tech: Secure Payment Gateway Development

Successive Tech stands at the forefront of fintech app development services, with being a crucial element for any fintech application handling transactions. The implementation of robust security measures—advanced encryption techniques and sophisticated fraud detection systems—is essential for safeguarding data and ensuring secure transactions.

For SaaS owners, prioritizing secure payment solutions is not just a best practice; it is vital for establishing trust with clients and adhering to industry regulations such as PCI DSS. Alarmingly, global payment fraud losses have surpassed $40 billion, highlighting the urgent need for stringent security measures.

Encryption methods like tokenization replace sensitive data with unique identifiers, ensuring that even if data is intercepted, it remains protected. Furthermore, effective fraud detection mechanisms, utilizing machine learning and behavioral analytics, can identify and mitigate potential threats in real-time.

As cybersecurity specialists emphasize, a secure payment system is paramount for maintaining customer trust and guarding against financial fraud, making it a top priority for fintech app development services. Additionally, the rising concerns over data breaches and cyber-attacks underscore the necessity of secure payment gateways, as they are essential for user trust in fintech app development services.

Conclusion

The landscape of fintech app development is undergoing rapid transformation, underscoring the critical need for comprehensive and tailored services. SaaS owners must prioritize innovative solutions that not only comply with regulatory standards but also elevate user engagement and satisfaction. By leveraging custom software development and emerging technologies, businesses can effectively position themselves within the competitive financial technology sector.

Key insights reveal the necessity of user-centric design, the integration of advanced features such as AI and real-time monitoring, and the essential role of compliance and security in fintech applications. Furthermore, understanding the cost breakdown and market dynamics is vital for making informed decisions that align with consumer expectations. With projections indicating substantial growth in the fintech sector, adapting to trends such as mobile payments and open banking will be pivotal for success.

In conclusion, the future of fintech app development hinges on embracing innovation and prioritizing user experience. SaaS owners are urged to invest in comprehensive development services that not only meet current market demands but also anticipate future trends. By doing so, they can ensure their applications not only thrive but also play a significant role in the ongoing transformation of the financial technology landscape.

Frequently Asked Questions

What is SDA and what services do they offer in fintech app development?

SDA is a provider of tailored software solutions for financial technology, offering fintech app development services that integrate advanced technology with strategic insight to meet regulatory standards and enhance user engagement.

What is the projected growth of the financial technology software market?

The financial technology software market is projected to grow from $44.52 billion in 2024 to $53.95 billion in 2025, with financial technology expected to reach $1.5 trillion in annual revenue by 2030.

What technologies does SDA leverage for fintech app development?

SDA utilizes expertise in JavaScript and React to create dynamic applications specifically tailored to the needs of financial technology companies.

Why is regulatory compliance important in fintech app development?

Regulatory compliance is crucial as it ensures that fintech applications adhere to legal standards, which is increasingly emphasized by financial technology professionals. Partnering with programming teams that understand these complexities is essential.

What key trends are expected to influence fintech app development by 2025?

Key trends expected to influence fintech app development include AI integration, mobile payments, and open banking.

What services does Artkai provide in fintech app development?

Artkai offers a comprehensive suite of fintech app development services, including UI/UX design, MVP development, and IT outstaffing, with a focus on client-centered design.

How does Artkai approach fintech app development?

Artkai employs agile methodologies to create adaptable fintech applications that meet evolving market demands, ensuring functionality and user engagement.

What is the significance of user-focused design in fintech solutions?

User-focused design is increasingly vital as consumers expect seamless experiences. It enhances client satisfaction and fosters trust, which is crucial in the financial services sector.

What are the main factors influencing the cost of fintech app development according to Binmile?

The main factors influencing the cost include design, construction, testing, maintenance, complexity of features, technology stack, and geographical location of the development team.

Why is understanding the cost components important for SaaS owners?

Understanding the cost components allows SaaS owners to strategically plan their budgets and allocate resources effectively for fintech app development, ensuring the success of their initiatives.