Overview

The article titled "10 Key Strategies for Custom Fintech Software Development Success" serves as a vital resource, outlining essential strategies that are pivotal for achieving success in custom software development within the financial technology sector. It asserts that a profound understanding of unique business needs, strict adherence to compliance and security measures, and the strategic use of emerging technologies such as AI and blockchain are not just beneficial but critical for crafting innovative and effective fintech solutions. These elements significantly enhance operational efficiency and user engagement, making them indispensable in today's competitive landscape.

Introduction

In the fast-paced world of financial technology, the necessity for custom software solutions has reached unprecedented levels. Fintech companies, in their quest to navigate intricate regulatory landscapes and meet the dynamic demands of customers, find that the strategies they implement for software development are pivotal to their success. This article explores ten essential strategies that not only enhance operational efficiency and compliance but also drive innovation and user engagement in fintech applications. With a myriad of approaches at their disposal, what truly sets apart successful fintech software development from the rest?

SDA: Tailored Custom Software Development for Fintech Success

SDA stands at the forefront of providing custom fintech software development meticulously designed for financial technology firms. Leveraging a profound understanding of the financial technology landscape, SDA guarantees that its software not only complies with regulatory standards but also significantly enhances user engagement and operational efficiency. This customized approach to custom fintech software development empowers financial technology companies to innovate rapidly while upholding compliance and security protocols, ultimately fostering their success in a fiercely competitive market.

For instance, Itransition exemplifies how tailored software can streamline operations and elevate compliance, facilitating clients in navigating complex regulatory environments. Their expertise in developing scalable SaaS platforms underscores the importance of flexible strategies in addressing the evolving demands of the financial technology industry. Similarly, Accedia's commitment to custom fintech software development has strengthened U.S.-based institutions in their digital transformation journeys, ensuring they effectively meet sector-specific challenges.

As the financial technology landscape evolves, trends such as the integration of AI for immediate fraud detection and the rise of decentralized finance (DeFi) underscore the necessity for adaptable software solutions. The projected growth of the RegTech sector to $22.3 billion by 2027 highlights the urgency for financial technology firms to implement custom fintech software development strategies that address regulatory compliance and security concerns. Industry leaders assert that successful custom fintech software development hinges on understanding unique business needs and delivering innovative solutions that promote operational excellence.

Looking ahead to 2025, the demand for personalized technology solutions will continue to expand, with an emphasis on security, sustainability, and compliance. This trend positions as a crucial component for success in the services sector.

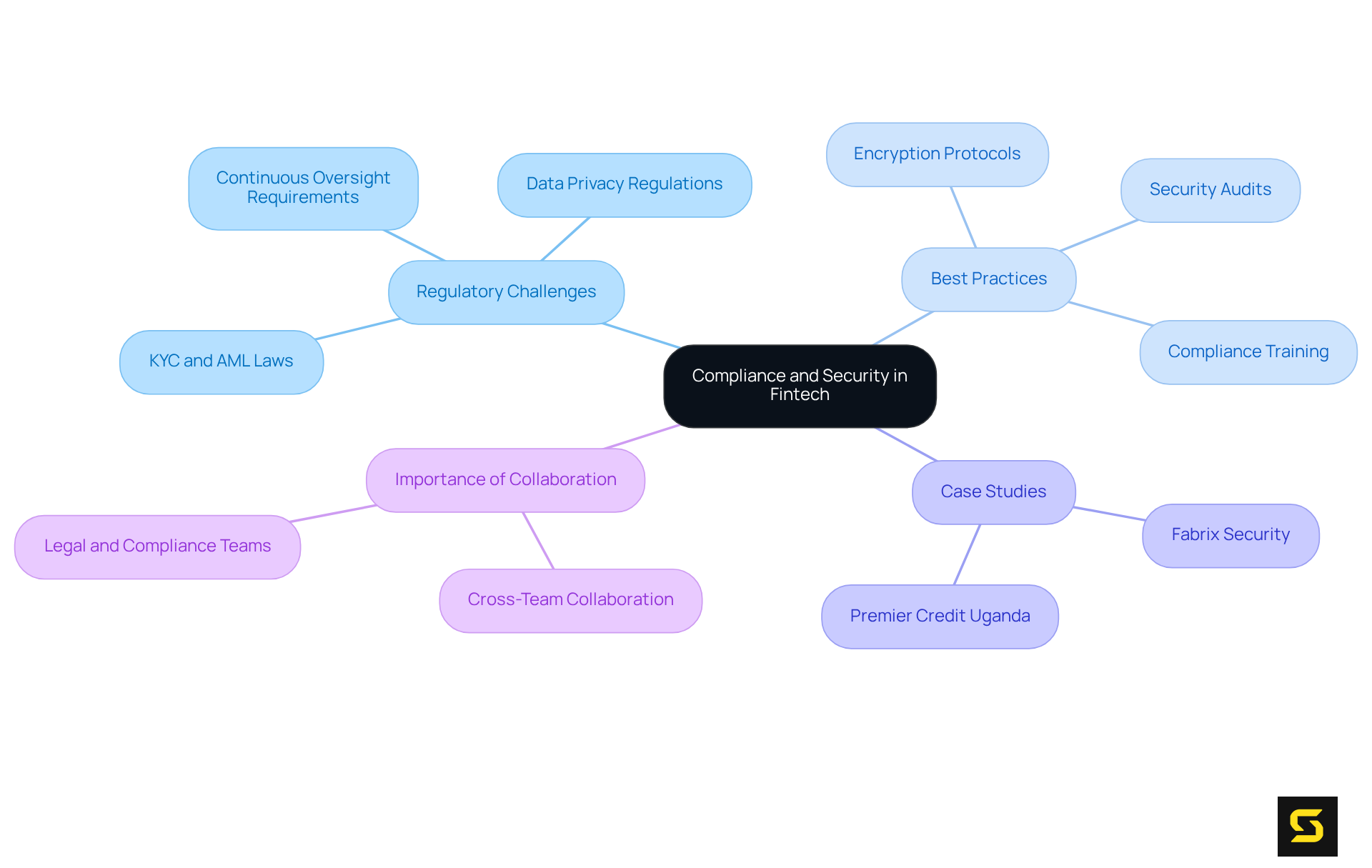

Compliance and Security: Navigating Regulatory Challenges in Fintech

Fintech companies navigate a complex regulatory landscape, particularly in relation to KYC (Know Your Customer) and AML (Anti-Money Laundering) laws. To safeguard sensitive monetary information and cultivate user trust, the implementation of robust security measures is imperative. Best practices encompass:

- Conducting regular security audits

- Employing strong encryption protocols

- Providing comprehensive compliance training for staff

These strategies not only assist financial technology companies in adapting to evolving regulatory requirements but also significantly mitigate the risks associated with data breaches.

For instance, the integration of AI-driven KYC and automated AML screening has demonstrated effectiveness in enhancing compliance efficiency while reducing human error. This proactive approach enables fintechs to manage their more adeptly as they scale. Furthermore, real-time transaction monitoring is increasingly vital, as regulators demand continuous oversight to combat fraud and ensure data protection.

Case studies underscore the significance of these strategies. Premier Credit Uganda, for instance, secured $1.5 million to expand its operations, highlighting how their compliance efforts have been instrumental in promoting financial inclusion. Similarly, fintechs that utilize custom fintech software development to adopt a compliance-by-design approach—embedding regulatory considerations into their product architecture—are better positioned to align with regulatory expectations and mitigate risks. As Nico Halle notes, specialized financial technology legal teams are essential in guiding companies through these intricate regulatory challenges. By fostering collaboration among engineering, product, and legal teams early in the development process, fintechs can streamline compliance strategies, reduce rework, and accelerate product approvals, ultimately enhancing client trust and operational integrity.

User Experience Design: Enhancing Engagement in Fintech Applications

A well-designed experience is indispensable for custom fintech software development, as it enables individuals to navigate platforms with remarkable ease and efficiency. Key components encompass:

- Intuitive interfaces

- Streamlined onboarding processes

- Personalized features tailored to individual preferences

By embracing client-focused design principles, fintech companies can significantly elevate engagement and satisfaction. For instance, Forrester Research reveals that a well-designed UI can enhance conversion rates by up to 200%, highlighting the critical role of intuitive design in customer retention. Successful case studies, such as the K&H Electra Netbank App and the Mauritian Telecommunication Company's Super App, illustrate that prioritizing user experience not only fosters loyalty but also drives long-term profitability. As one specialist noted, "Fintechs that emphasize seamless, anticipatory, and secure experiences have the potential to lead the industry."

Furthermore, the integration of security protocols into user experience design is vital, given the sensitivity of monetary information. This focus on is essential for companies involved in custom fintech software development striving to thrive in a competitive landscape.

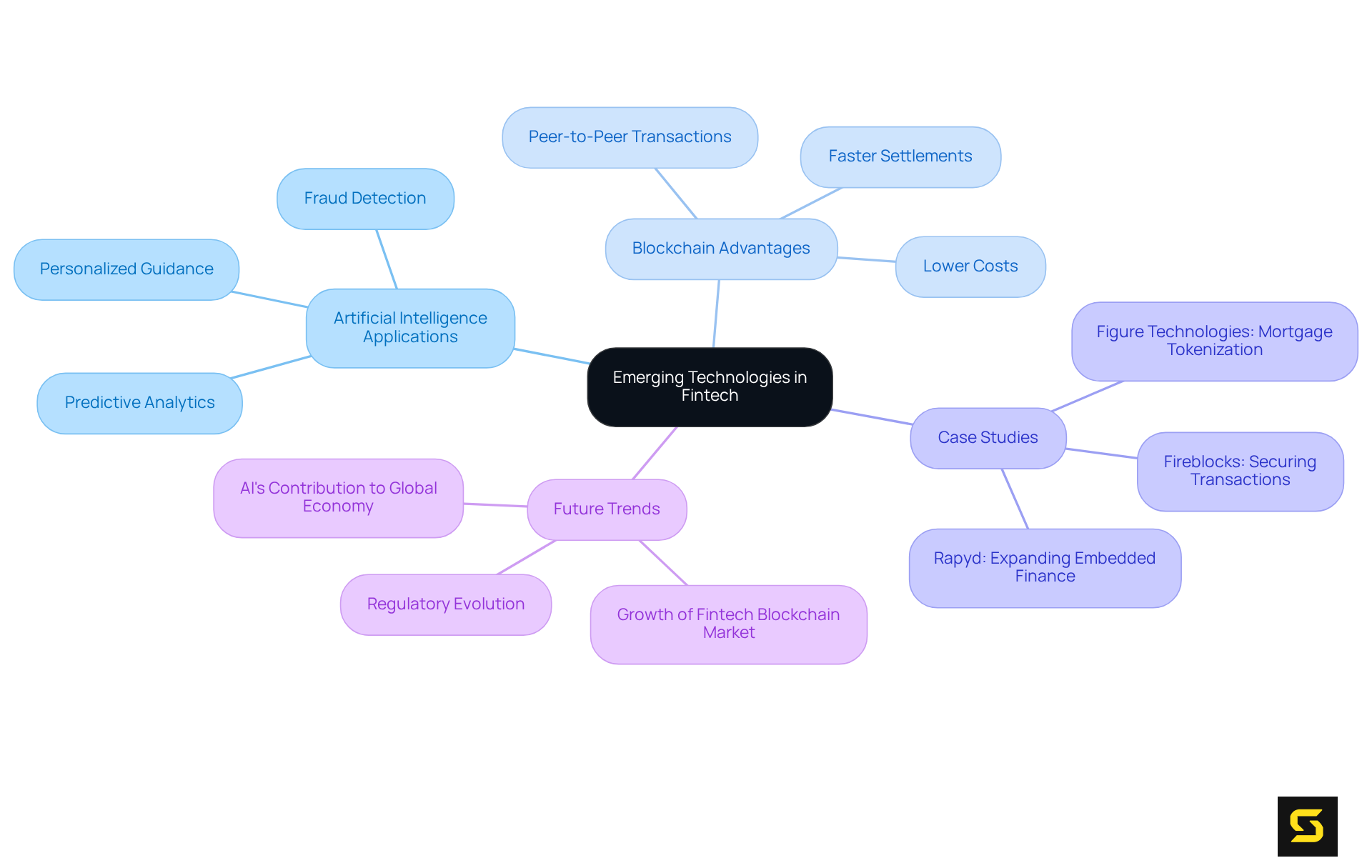

Emerging Technologies: Leveraging AI and Blockchain in Fintech Development

Fintech companies are increasingly harnessing emerging technologies such as artificial intelligence (AI) and blockchain to elevate their service offerings. AI plays a vital role in predictive analytics, fraud detection, and providing personalized monetary guidance, while blockchain technology ensures secure and transparent transaction processes. The combination of these technologies not only improves operational efficiency but also considerably lowers expenses, allowing financial technology companies to offer innovative services that meet the evolving needs of their clients.

The advantages of blockchain are particularly noteworthy; it facilitates peer-to-peer transactions on a shared ledger, which can lower transaction costs and expedite settlement times. For instance, cross-border payments that once took days can now be settled within minutes, making them faster and more cost-effective. This capability is essential for global platforms managing large transaction volumes, as it enhances trust and transparency in monetary dealings.

Experts in the field emphasize the importance of these technologies. Kent Henderson, VP of Product Management at Mangopay, notes that blockchain can significantly lower barriers for small businesses and entrepreneurs, enabling them to engage in international commerce more effectively. Moreover, the fintech blockchain market soared to $4.92 billion in 2025 and is anticipated to expand at an astonishing CAGR of 55.1%, achieving $265.96 billion by 2034, highlighting the technology's capability to transform the economic landscape. Additionally, stablecoins facilitate $1.2 trillion in daily transactions, underscoring blockchain's practical utility in traditional finance.

Successful case studies illustrate the practical applications of these technologies. Figure Technologies, for example, has tokenized $13 billion in home equity lines of credit, demonstrating how blockchain can connect traditional finance with inventive approaches. Likewise, firms such as Rapyd are broadening embedded finance in developing markets, enabling simpler access to monetary services and promoting economic inclusion.

As financial technology continues to evolve, the strategic integration of AI and blockchain will be pivotal in enhancing operational efficiency and delivering tailored financial solutions through custom fintech software development that meet the diverse needs of customers. However, it is essential to remain vigilant about the rising cybersecurity concerns associated with these technologies, ensuring that the benefits are realized without compromising security.

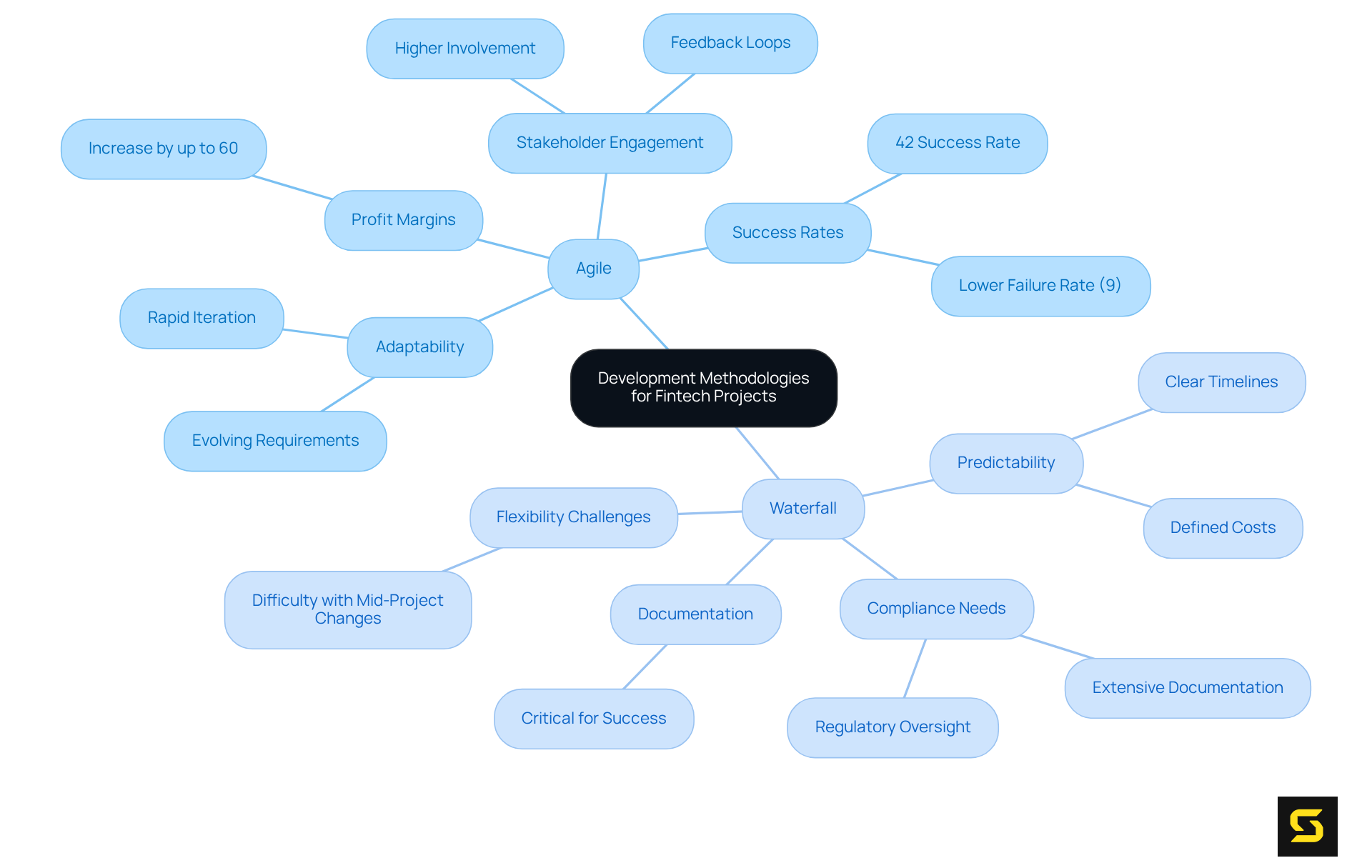

Development Methodologies: Choosing the Right Approach for Fintech Projects

Choosing the appropriate development methodology is crucial for the success of custom fintech software development projects, as it directly influences timelines, budgets, and overall outcomes. Agile methodologies, renowned for their adaptability and rapid iteration, are particularly advantageous in the dynamic financial technology landscape. They empower teams to swiftly adjust to evolving requirements and regulatory demands, fostering innovation and responsiveness. Notably, Agile practices can enhance profit margins by up to 60%, significantly improving project adaptability and stakeholder engagement. This adaptability is vital, especially considering that only 36% of teams in low-performing companies successfully complete projects, highlighting the necessity of effective methodologies in achieving project success.

Conversely, Waterfall methodologies may be more fitting for projects with clearly defined requirements and stringent compliance needs. This traditional approach offers predictability in costs and timelines, which can be beneficial for projects necessitating extensive documentation and regulatory oversight. However, it often lacks the flexibility required to accommodate mid-project changes, leading to challenges in rapidly evolving industries like financial technology. Significantly, only 45% of companies utilizing project management tools achieve all or most of the anticipated outcomes, underscoring the importance of effective project management methodologies in the financial technology sector.

Understanding the of both methodologies enables financial technology firms to make informed decisions that support their goals in custom fintech software development. For instance, while Agile facilitates rapid feature iteration and improved time-to-market, Waterfall's structured approach can be advantageous for compliance-heavy projects. As noted by OceanoBe, "Agile methodologies—Scrum, Kanban, and hybrid frameworks—enable financial technology teams to remain responsive without compromising quality or compliance." Ultimately, the selection of methodology can significantly influence project success rates, with Agile projects exhibiting a higher success rate compared to their Waterfall counterparts. Furthermore, with 68% of all projects lacking an effective sponsor, stakeholder involvement is critical in selecting the appropriate methodology. By leveraging the right development methodology, financial technology companies can enhance their prospects of delivering successful, innovative solutions through custom fintech software development that meet market demands.

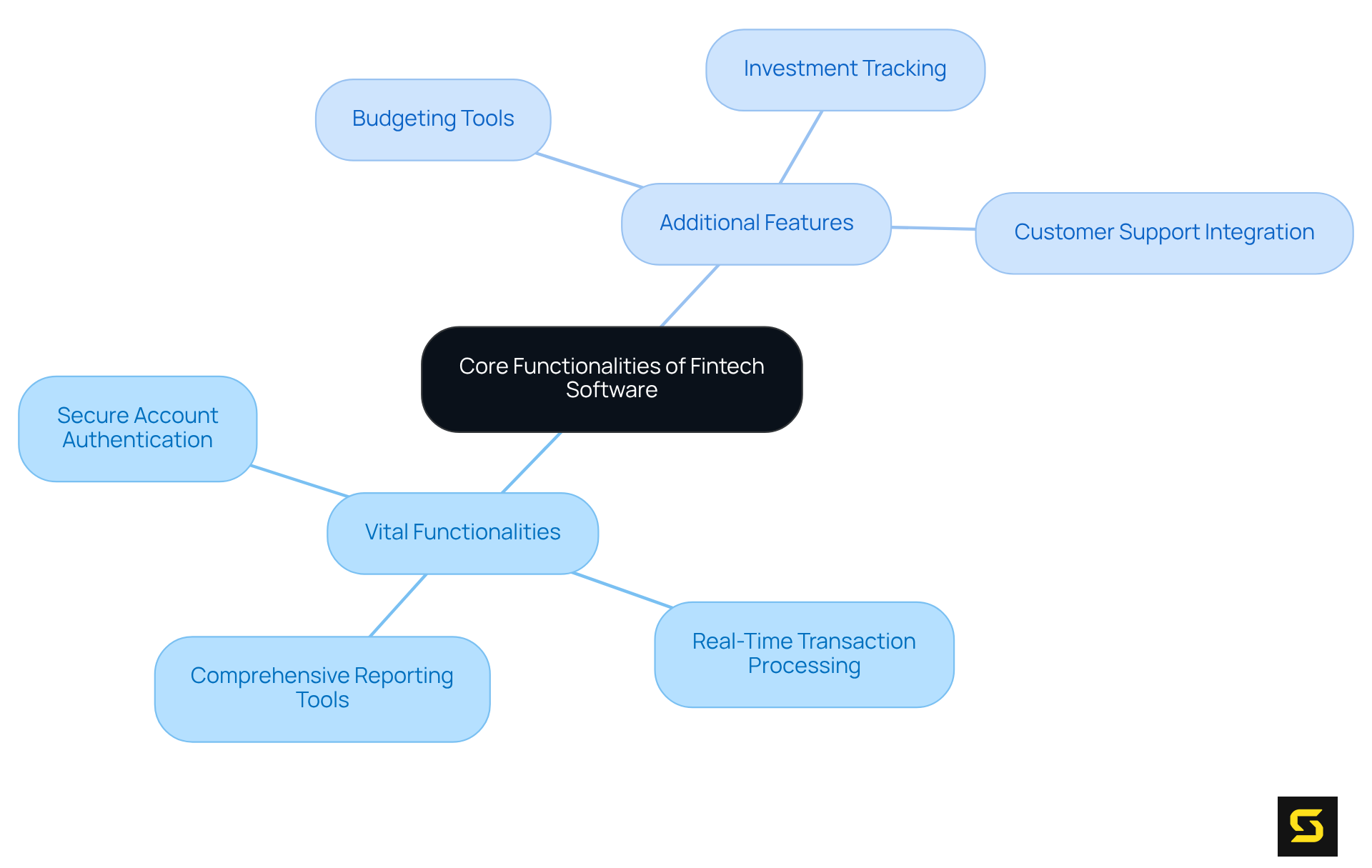

Core Functionalities: Defining Essential Features for Fintech Software

Fintech software must encompass vital functionalities, including secure account authentication, real-time transaction processing, and comprehensive reporting tools. Additionally, features such as budgeting tools, investment tracking, and customer support integration are crucial. By prioritizing these essential functionalities, financial technology firms can create robust applications that not only meet client expectations but also significantly enhance engagement and satisfaction. This strategic focus not only positions firms as leaders in the industry but also fosters .

Scalability: Ensuring Growth Potential in Fintech Solutions

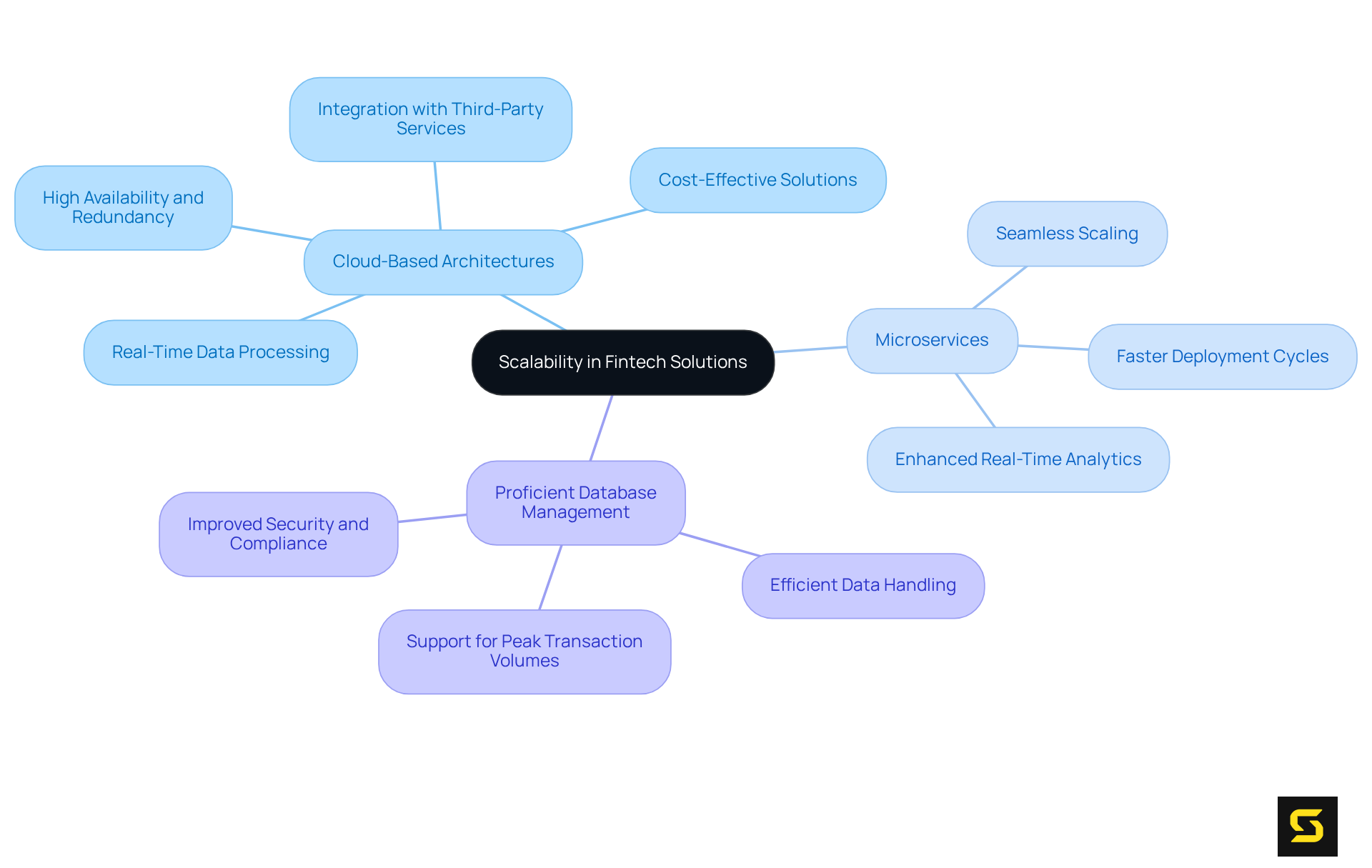

Creating scalable financial technology solutions through custom fintech software development is essential for effectively managing growth and meeting the increasing demands of clients. This goal can be achieved through the implementation of:

- cloud-based architectures

- microservices

- proficient database management

By developing systems designed for seamless expansion, financial technology firms can ensure their applications remain responsive and efficient, even as user numbers and transaction volumes rise. Such capabilities not only enhance operational efficiency but also position firms to capitalize on emerging opportunities in a competitive landscape.

Tech Stack Selection: Building a Robust Foundation for Fintech Software

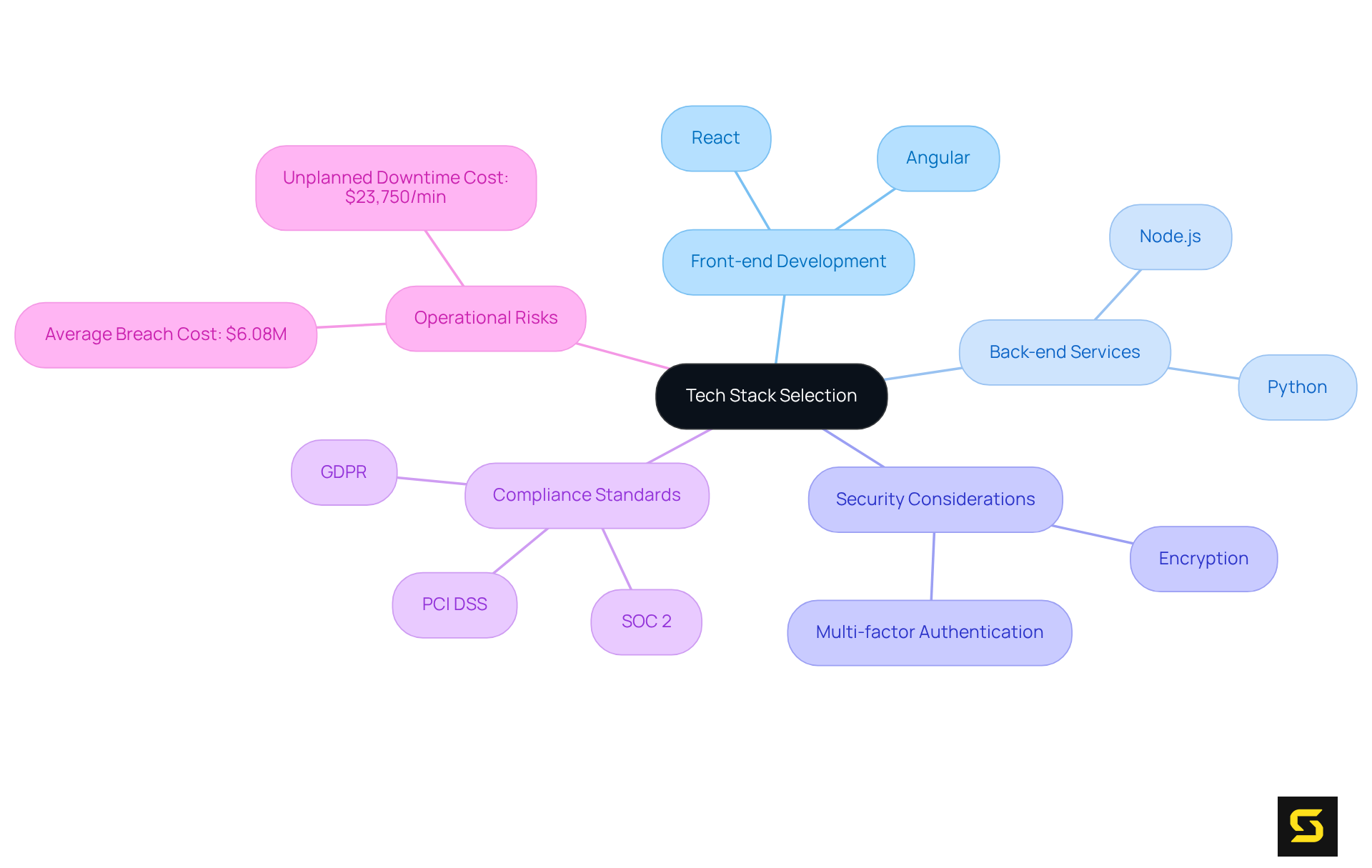

Choosing the right technology stack is crucial for the success of custom fintech software development, as it significantly impacts security, performance, and integration with existing systems. JavaScript frameworks such as React and Angular are preferred for front-end development due to their flexibility and user-friendly interfaces. Meanwhile, Node.js and Python are commonly used for , providing robust performance and scalability. A well-structured tech stack not only enhances application efficiency but also ensures compliance with industry regulations, seamlessly integrating security measures like encryption and multi-factor authentication.

Given that the average breach cost in financial services reached $6.08M in 2024, prioritizing security in tech stack selection is imperative. Furthermore, Gartner indicates that over 90% of financial technology scale-ups will adopt hybrid-cloud or cloud-native solutions by 2025, underscoring the importance of modern tech stacks in maintaining compliance and security. Additionally, unplanned downtime can cost large enterprises approximately $23,750 per minute, illustrating the operational risks linked to inadequate tech stack choices.

Adherence to standards such as PCI DSS, SOC 2, and GDPR is also vital for financial technology applications. As the financial technology landscape evolves, selecting the right tech stack for custom fintech software development can greatly enhance user experience and operational effectiveness, making it a foundational element in the development process.

Strategic Partnerships: Collaborating for Success in Fintech Development

Strategic partnerships are essential for fintech companies seeking to enhance their offerings and expand their market reach. Collaborations with financial institutions, technology providers, and regulatory agencies foster innovative solutions that effectively address customer needs. A prime example is HSBC's partnership with Tradeshift, which successfully digitized global supply chains, demonstrating how co-developed solutions can improve operational efficiency and visibility for businesses. Similarly, Barclays' collaboration with Form3 streamlined cross-border transactions, unlocking new revenue streams and illustrating the power of integrated ecosystems.

By leveraging the unique strengths of their partners, financial technology firms can accelerate growth and enhance their competitive positioning. A notable instance is the strategic alliance between State Street Corporation, managing $5.1 trillion in assets, and Apex Fintech Solutions, which enhances wealth services capabilities and positions both firms to better meet global investment objectives. This partnership exemplifies how fintechs can through institutional credibility and shared expertise.

Industry leaders assert that establishing trust and clear communication is crucial for successful collaborations. Bill Capuzzi, CEO of Apex Fintech Solutions, articulates that "the rapid changes in wealth management necessitate backend systems that are fast, flexible, and secure." This sentiment resonates throughout the sector, where collaborative innovation is increasingly recognized as a cornerstone of sustainable value creation.

Moreover, the partnership between UBS and Automation Anywhere achieved an impressive 85% reduction in processing time for loan processing automation, underscoring the tangible benefits of strategic alliances. However, it is vital to acknowledge that challenges such as misaligned objectives and integration complexities can emerge in financial technology partnerships.

In conclusion, the future of financial technology hinges on the understanding that collaboration—not competition—is key to driving innovation, scalability, and customer loyalty. By forging strategic alliances, financial technology firms can not only enhance their service offerings but also significantly broaden their market reach.

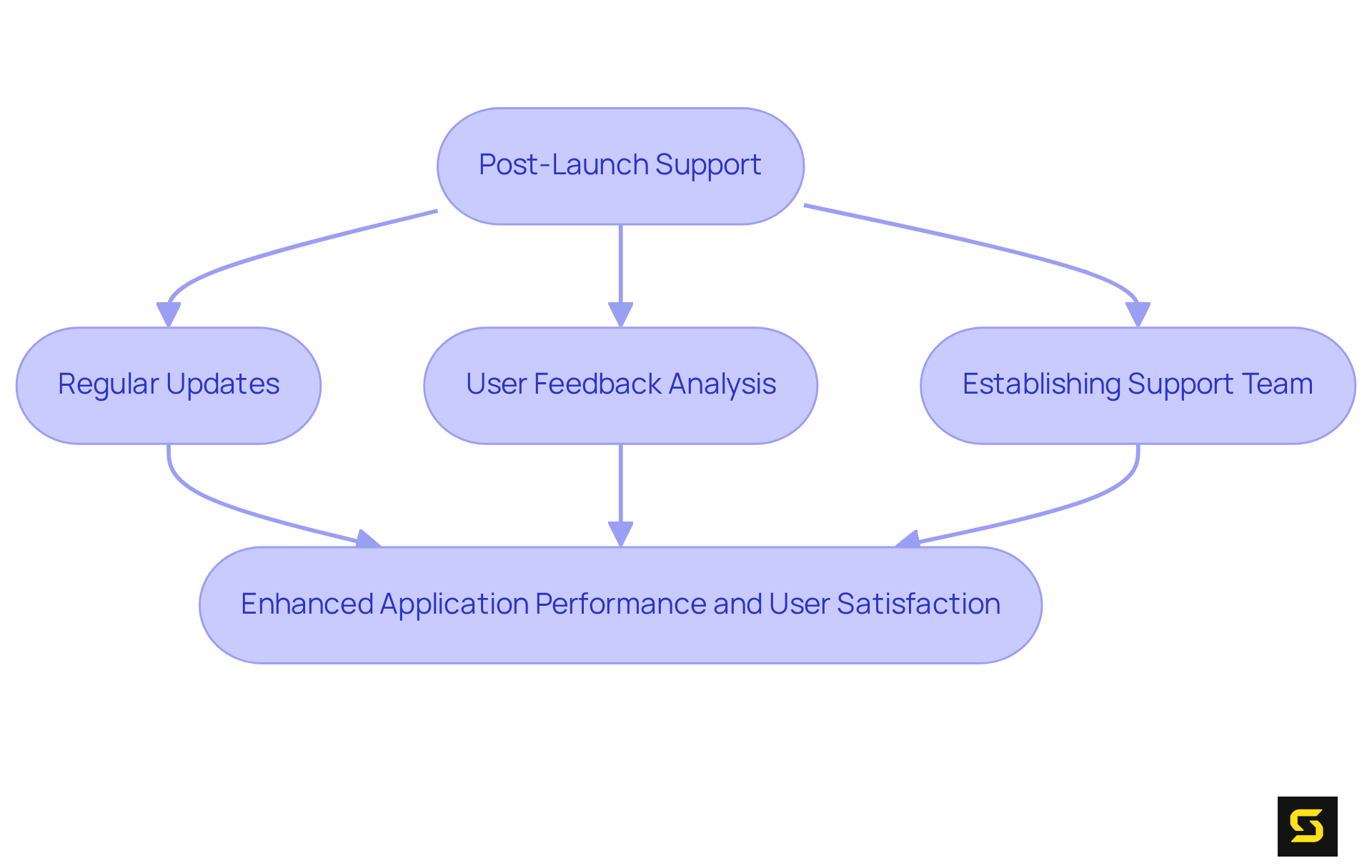

Post-Launch Support: Maintaining and Evolving Fintech Applications

Post-launch support is paramount for maintaining the performance and relevance of fintech applications. Regular updates and bug fixes are not merely beneficial; they are essential for addressing emerging issues and enhancing functionality. By examining feedback from users, organizations can identify areas for improvement, ensuring that applications evolve in tandem with user needs and market trends.

Establishing a dedicated support team is critical for sustaining application performance, as it facilitates prompt responses to inquiries and technical challenges. This proactive approach not only elevates client satisfaction but also fosters retention, ultimately contributing to the long-term success of financial technology solutions.

Given that the fintech market is projected to grow at a CAGR of 9.2% to $158 billion, the necessity of ongoing support becomes increasingly vital. A recent survey revealed that 61% of mobile banking clients would consider switching banks if their current institution offered a subpar experience, underscoring the importance of high customer satisfaction.

To further enhance your application’s relevance, implement a with users, allowing for continuous adaptation to their evolving needs.

Conclusion

The success of custom fintech software development relies on a multifaceted approach that demands a profound understanding of regulatory compliance, user experience, and emerging technologies. By customizing solutions to address the unique needs of the financial sector, companies can significantly enhance operational efficiency while also driving innovation and growth. This strategic emphasis on customization and adaptability is vital for navigating the complexities of the fintech landscape.

Key strategies such as:

- Prioritizing compliance and security

- Leveraging user-centered design

- Integrating advanced technologies like AI and blockchain

are essential components for success. Additionally, the careful selection of development methodologies and tech stacks, coupled with the cultivation of strategic partnerships, is crucial in ensuring that fintech solutions are not only effective but also sustainable in a rapidly evolving environment.

In a financial technology sector poised for substantial growth, the significance of implementing these strategies is paramount. As companies endeavor to meet rising customer expectations and regulatory demands, a steadfast commitment to continuous improvement and collaboration will be essential. Embracing these principles will not only facilitate successful custom fintech software development but also establish firms as leaders in a competitive market, ultimately driving innovation and fostering customer loyalty.

Frequently Asked Questions

What is SDA's role in fintech software development?

SDA provides custom fintech software development tailored for financial technology firms, ensuring compliance with regulatory standards and enhancing user engagement and operational efficiency.

How does custom software development benefit fintech companies?

Custom software development empowers fintech companies to innovate rapidly while maintaining compliance and security, helping them succeed in a competitive market.

What are some examples of companies that excel in custom fintech software development?

Itransition and Accedia are examples of companies that have successfully developed tailored software solutions to streamline operations and support digital transformation for financial institutions.

What trends are shaping the future of fintech software development?

Key trends include the integration of AI for fraud detection, the rise of decentralized finance (DeFi), and the growth of the RegTech sector, which is expected to reach $22.3 billion by 2027.

What are the best practices for compliance and security in fintech?

Best practices include conducting regular security audits, employing strong encryption protocols, and providing comprehensive compliance training for staff.

How can AI enhance compliance in fintech?

AI-driven KYC and automated AML screening improve compliance efficiency and reduce human error, allowing fintechs to manage regulatory obligations more effectively.

What is a compliance-by-design approach in fintech software development?

A compliance-by-design approach embeds regulatory considerations into the product architecture, helping fintechs align with regulatory expectations and mitigate risks.

What role does user experience design play in fintech applications?

User experience design is crucial for enabling users to navigate platforms easily and efficiently, which enhances engagement and satisfaction.

What are key components of effective user experience design in fintech?

Key components include intuitive interfaces, streamlined onboarding processes, and personalized features tailored to individual user preferences.

How does user experience design impact customer retention in fintech?

A well-designed user interface can enhance conversion rates significantly, with studies indicating increases of up to 200%, thereby promoting customer retention and loyalty.